Close search

By Alexander Reed

Last Updated: Apr 1, 2025

Co-author

By Francesca Farrugia

Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

99Bitcoins may receive advertising commissions for visits to a suggested operator through our affiliate links, at no added cost to you. All our recommendations follow a thorough review process.

Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

99Bitcoins may receive advertising commissions for visits to a suggested operator through our affiliate links, at no added cost to you. All our recommendations follow a thorough review process.

An increasing number of traders are turning to automated crypto strategies and looking for the best automated crypto trading platforms. Auto trading strategies can help reduce the need to perform analysis or trade manually while allowing trades to occur 24/7. But what are the best automated crypto trading platforms for 2025?

This guide reveals 12 popular crypto platforms that support automated trading. I cover the intricacies of automated crypto trading and the different options available, including fully autonomous systems, copy trading, and custom bots.

The 12 best automated crypto trading platforms are listed below:

I’ll now review the auto crypto trader platforms listed above. Read on to get started with the right automated system for your crypto trading goals.

My top pick is Dash 2 Trade. It offers a fully automated service, allowing investors to buy and sell crypto passively, and is ideal for both beginners and experienced traders. First, users must choose their preferred exchange.

Dash 2 Trade supports the best Bitcoin exchanges, including Binance and Kraken. Next, users can choose which crypto tokens they want to auto-trade. There are no limitations here, but it’s best to stick with liquid pairs like BTC/USD and ETH/USD. After that, you can select your preferred trading strategy. The most popular options include dollar-cost averaging and grid trading. Dash 2 Trade also enables you to choose your exposure levels. For instance, you might only want to risk $10 per trade.

You can then deploy your trading bot via the demo platform. Once the bot is ready to trade with real money, it can be activated. Like most automated platforms, Dash 2 Trade charges a monthly subscription. This starts from $10 per month on flexible plans, but discounts are available when paying in crypto. While there’s also a free plan, this doesn’t support auto trading.

Visit Dash 2 Trade

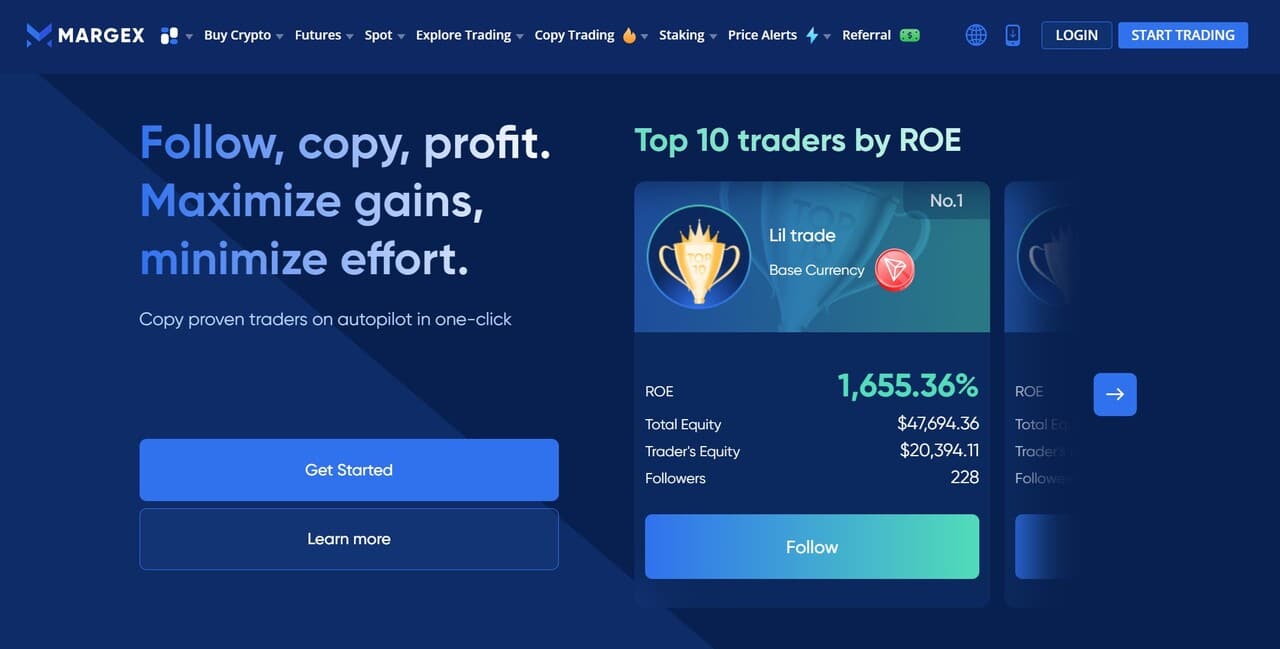

Margex is a popular crypto exchange that’s been around since 2019. Thanks to its simple platform and fast order execution that uses liquidity from more than 12 providers, Margex has become a leading option for automated trading. Using the copy trading feature, investors who want to take the hands-off approach can filter through various traders and select the ones that meet their goals.

For that purpose, Margex has created a Leaderboard where users can find the top-performing traders. The Leaderboard lists traders based on return on equity. However, other metrics such as total equity, trader’s equity, and number of followers are also available for review.

Starting your copy trading journey is simple. Fund your Margex account and select the trader you wish to copy. Use the “Follow” button and select the amount you wish to allocate to copying that particular trader. You can follow multiple traders and watch their performance under the “Portfolio” section. Minimum deposit to start copying is $10 USDT, but this could vary between traders.

Visit Margex

MEXC is a leading crypto exchange – especially for derivatives trading – thanks to its near-zero fees, high leverage, and thousands of cryptocurrencies available for trading. Currently, over 10 million users globally have selected MEXC as their primary trading platform.

Those who want to automate their trading will find MEXC’s copy trading features to be among the best in the industry. Allowing users to start with as little as $5, although a minimum of $50 is recommended, users can find a trader they like and start copying their trades with ease.

Advanced users who want to build their own trading bots can use the MEXC API for trading over 1,200 cryptocurrencies. MEXC also provides SDK with several coding languages, including Python, GO, and JAVA. If you need further assistance, the API Telegram group can lend you a hand.

Visit MEXC

BloFin is a straightforward and reliable crypto exchange with spot, futures, and copy trading. Whether you’re new to trading or already experienced, it has everything you need in one place.

A key feature is the Unified Trading Account (UTA). It lets you trade different markets from a single account, so you don’t have to switch between wallets. The BloFin mobile app for iOS and Android, on the other hand, makes it easy to manage trades anytime, anywhere.

Security is a priority, too. BloFin uses Fireblocks for cold storage, keeping funds safe. And if you want to practice before using real money, there’s demo trading to test strategies risk-free.

Key Features of BloFin:

Visit BloFin

Cryptohopper is one of the best automated crypto trading platforms for building custom strategies. First, you’ll need to spend some time building your strategy parameters. No coding knowledge is required, but you’ll need a basic understanding of trading indicators. After all, the Cryptohopper bot needs to know when and what to trade.

A simple bot strategy could be to buy Bitcoin whenever the RSI drops below 30 or to sell Bitcoin when it surpasses 70. You could also add some additional metrics, such as only executing positions between Monday and Friday and when daily trading volumes are above $20 billion. The possibilities are endless.

Most importantly, Cryptohopper enables you to test automated trading strategies in demo mode. You can also backtest the strategy for additional insights. Adjustments can be made when needed. Cryptohopper is compatible with most exchanges – you simply need your unique API key. Prices range from $0 to $129 per month.

Visit Cryptohopper

Coinrule is another platform that supports custom bot strategies. It leverages a rule-based system that requires zero coding knowledge. Users can build their strategy from the ground up by selecting their preferred trigger points. A simple example is buying Litecoin whenever the 24-hour price declines by 3% or more.

However, more sophisticated strategies have the best chance of success. For example, you can incorporate technical indicators into the strategy. This includes the MACD, moving averages, and Fibonacci retracement levels. Once deployed, the Coinrule bot will scan the markets 24 hours per day, 7 days per week.

It will enter buy or sell orders when a rule is triggered. Supported crypto exchanges include OKX, Binance, Kraken, and KuCoin. Coinrule also supports Uniswap. This means your bot can trade on the world’s most popular decentralized exchange. Depending on your requirements, you’ll pay between $29.99 and $449.99 per month.

Pros

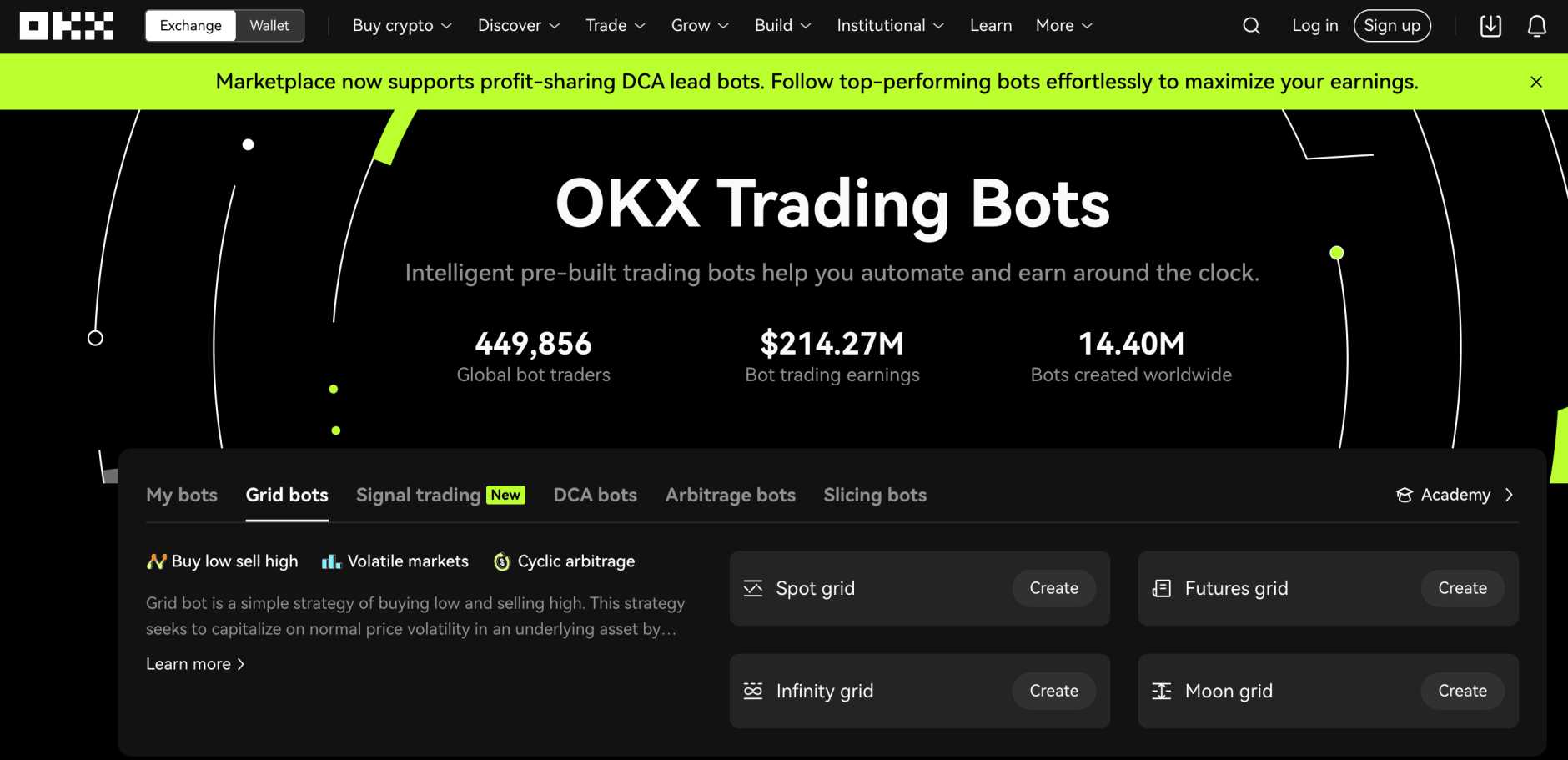

OKX is a popular crypto exchange that lists more than 14 million bot creations. There are many different strategies to choose from. The main bot categories are arbitrage, slicing, grid, and DCA trading. Some OKX bots specialize in leveraged futures, which will appeal to high-risk investors.

For example, futures commissions amount to just 0.05% of the position size. Lower commissions are offered when trading larger amounts. In terms of markets, OKX supports the best altcoins to trade. This includes small and large-cap markets. OKX can be accessed on the browser-based platform or mobile app.

Visit OKX

Another tool that’s worth considering is Binance Trading Bot, a well-known automated solution that allows traders to execute crypto trades passively. It’s suitable for both novice and experienced traders who wish to capitalize on market movements without being glued to their screens. Like other platforms, you must first connect your Binance account to get started.

The Binance Trading Bot integrates seamlessly with the Binance exchange, giving you access to a wide range of cryptocurrencies. You can choose which crypto assets to trade, with no restrictions, though sticking to highly liquid pairs like BTC/USDT and ETH/USDT is recommended. Users can also customize their trading strategies, with popular options such as grid trading and market making. The bot also allows you to set up risk parameters, such as stop-loss orders, to control potential losses.

Additionally, Binance provides a demo trading mode, allowing you to test strategies without risking real money. Once comfortable, you can switch to live trading and let the bot execute your strategies in real time. The Binance Trading Bot does not require a subscription, as it’s part of the broader Binance ecosystem. However, standard trading fees apply on each transaction.

As a trading enthusiast, I have to say that ByBit Trading Bot also does a lot for me in the crypto investing sphere. This is primarily because it provides a handy solution to automating users’ crypto trades effortlessly. This platform is suitable for both beginners and advanced traders, offering a simple and convenient way to execute trades without the need for constant monitoring.

ByBit Trading Bot is fully integrated with the ByBit exchange, offering access to a variety of crypto assets, including popular pairs like BTC/USDT and ETH/USDT. Users can easily set their preferred trading strategies, such as dollar-cost averaging or grid trading, with the flexibility to adjust parameters like take-profit and stop-loss orders. The bot also provides full control over risk management, allowing you to set exposure limits to minimize potential losses.

It also presents investors with a demo mode, where they can test their strategies risk-free before committing to real capital. Once you are ready, you can switch to live trading. The ByBit Trading Bot is free to use, though standard exchange trading fees apply on each transaction.

Important Note: ByBit lost nearly $1.5 billion in customer funds in a security breach on 21 February 2025. We will suggest readers be cautious when choosing any of ByBit-related products at this time.

PrimeXBT is the go-to automated platform for a streamlined trading process. With it, you can capitalize on market opportunities without constant supervision. I consider it an effective automated trading solution ideal for both rookie and veteran crypto traders.

With the PrimeXBT trading tool, users can enjoy a variety of trading strategies, such as copy trading, grid trading, and momentum-based strategies. You can look forward to smooth integration with the PrimeXBT platform, providing access to multiple crypto pairs, including BTC/USD and ETH/USD. You also get risk management features like stop-loss and take-profit orders to help you maintain control over your capital.

PrimeXBT offers demo trading facilities for users who wish to test strategies before committing real funds. Once you’re ready to go live, the bot operates continuously, ensuring your strategies are executed even when you’re away. PrimeXBT does not charge any subscription fees for using the trading bot, though trading fees on transactions still apply.

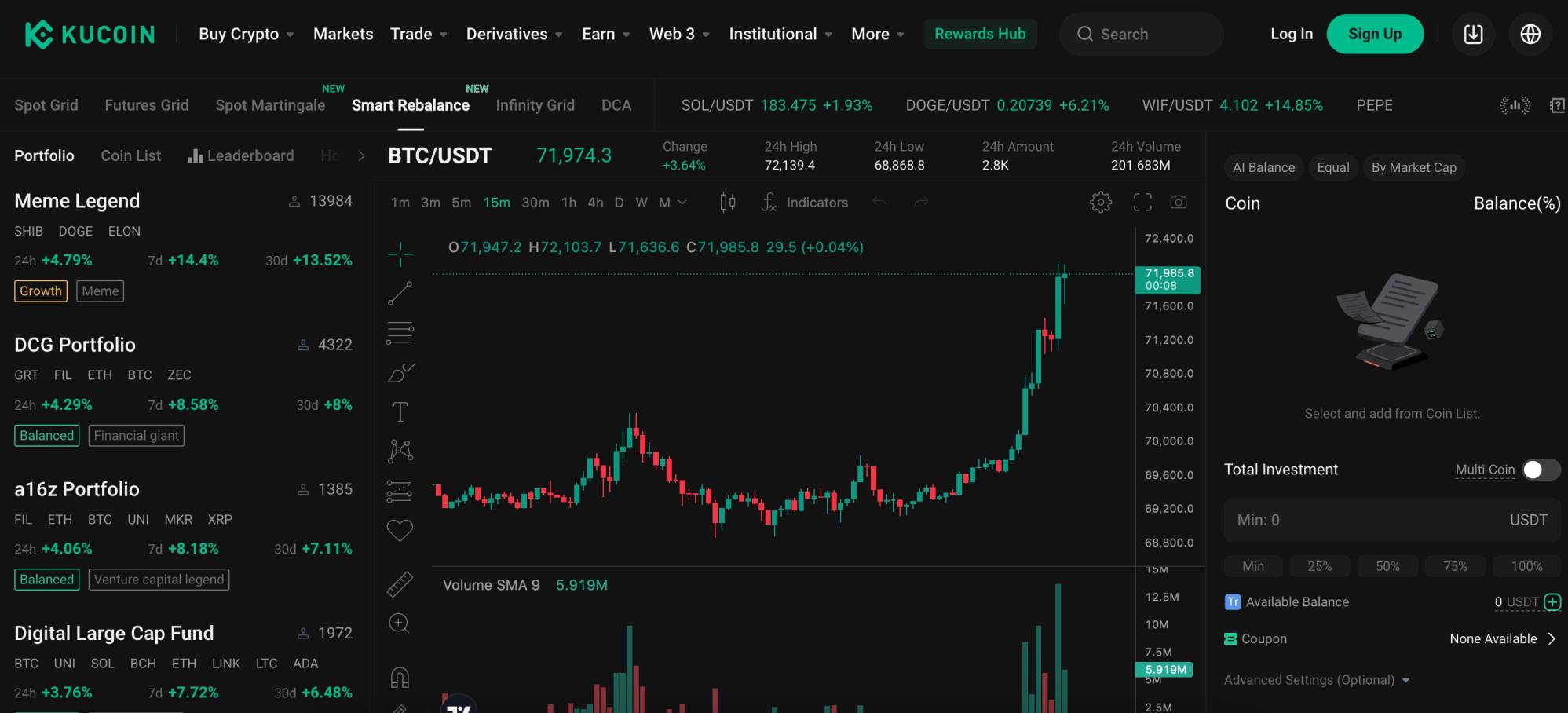

KuCoin is one of the best automated crypto trading platforms for long-term investing. It offers smart rebalancing portfolios that track popular crypto niches. This enables investors to gain exposure to multiple coins from a particular narrative. The bot automatically rebalances the portfolio based on broader market conditions and risk.

One option is the Defi Leaders portfolio, which contains Aave, Uniswap, Chainlink, and Avalanche at various weights. The Digital Large Cap Fund is also popular. It tracks the largest coins by market capitalization, including Bitcoin, Ethereum, Solana, and Bitcoin Cash.

There are thousands of other portfolios to choose from. No minimum investment requirements are in place, so you can easily diversify across multiple niches—even with a small account balance. Best of all, there are no fees when using KuCoin bots. Investors simply need to cover standard commissions. KuCoin charges 0.1% per slide.

Visit KuCoin

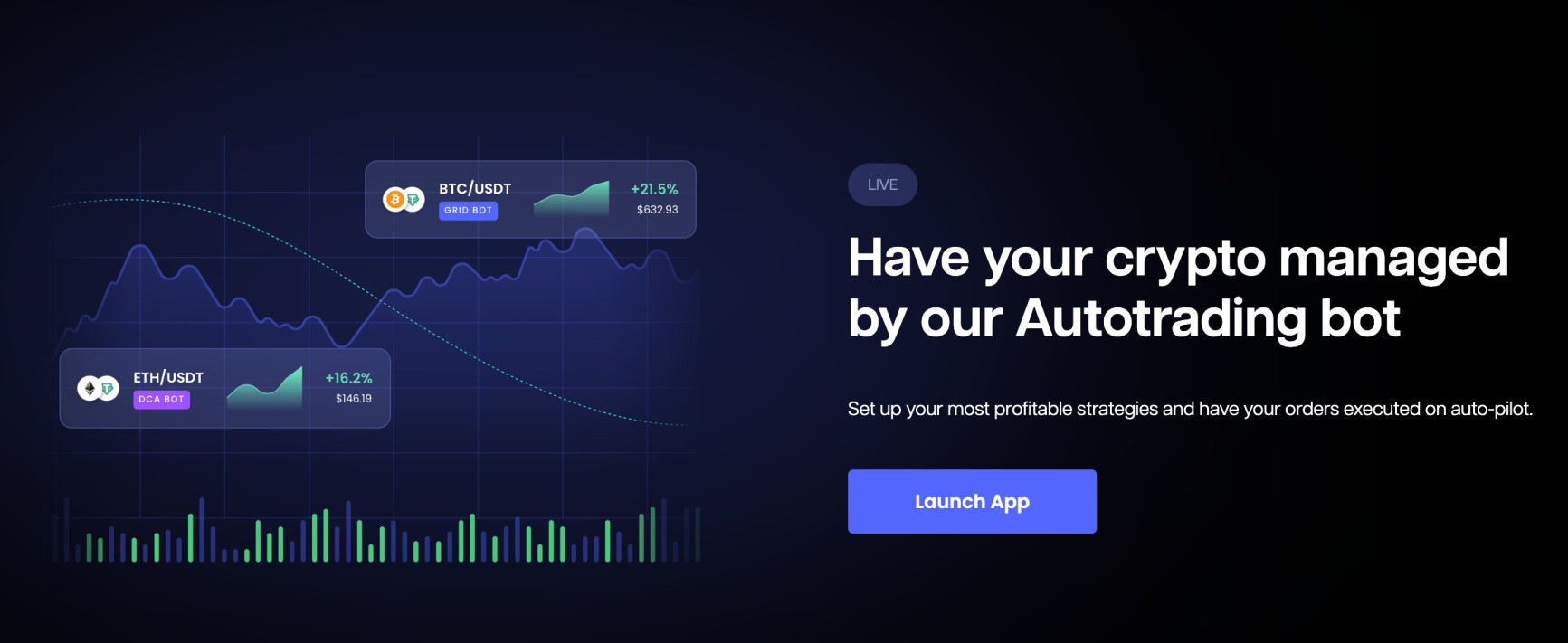

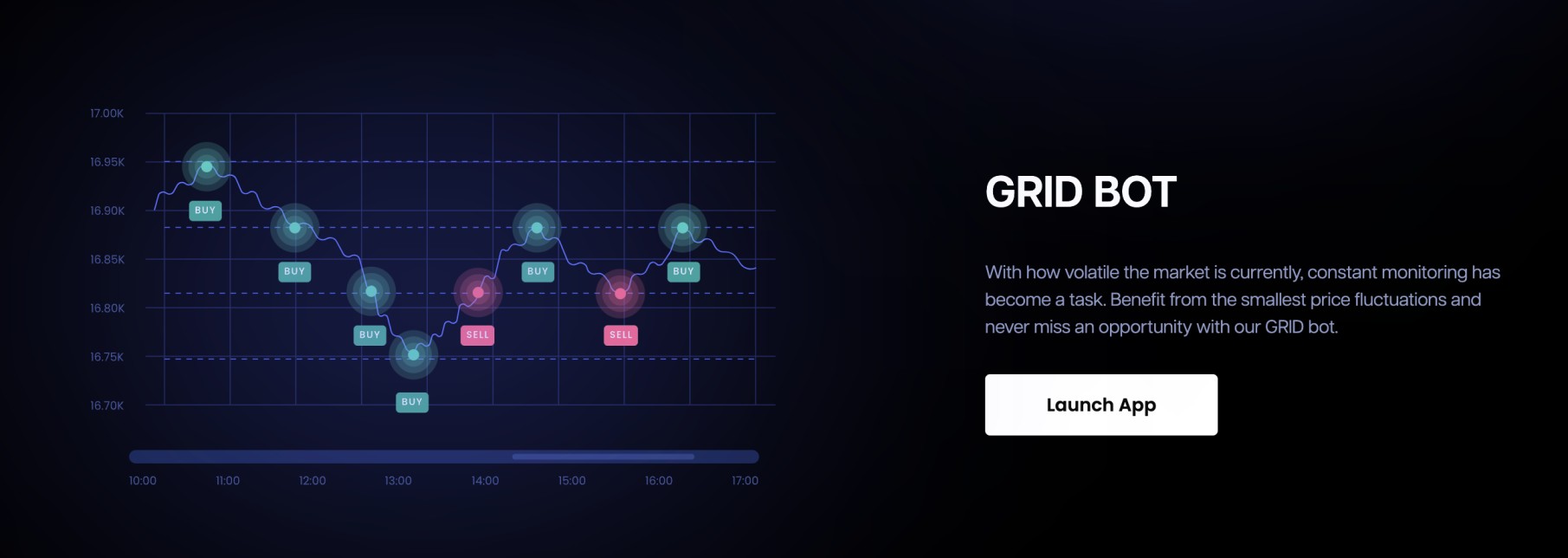

Bitsgap is one of the best automated crypto trading platforms for dollar-cost averaging (DCA). It enables investors to create bespoke DCA strategies. The Bitsgap dashboard offers a solid user experience, meaning it appeals to beginners and seasoned pros alike. The first step is to decide which cryptocurrencies you want to DCA.

Bitsgap supports some of the best cryptocurrencies to buy, including Bitcoin and Ethereum. It also supports popular exchanges like Binance, Bitfinex, Gemini, Gate.io, and Kraken. After that, you can set your DCA parameters. For example, you can buy crypto based on technical indicator readings, which could mean buying Ethereum based on Fibonacci retracement levels.

Alternatively, you can keep things simple by setting specific DCA intervals. For instance, you could buy $50 worth of XRP every Wednesday. Bitsgap also supports backtesting, pump and dump protections, multiplier strategies, and take-profit orders. Pricing plans cost $29, $69, and $149 per month. Each plan comes with different levels of functionality.

Visit Bitsgap

Automated crypto trading offers a passive investing experience. This means you can invest in the crypto markets without any experience. Most platforms in this space offer automated bots. They place buy and sell orders based on pre-set conditions.

For example, consider a Dollar Cost Averaging (DCA) automated bot that targets Bitcoin. This bot will automatically buy or sell Bitcoin at specific intervals or in response to certain price movements.

It might buy Bitcoin whenever the price declines by 2%. Or, it might place a buy order when a technical indicator has been triggered. This could be anything from the Fibonacci retracement levels to the 50-day moving average. Either way, bots operate autonomously 24/7, so they never miss a trading session.

Another way to automate your crypto investments is copy trading. This also offers a passive experience, but you’ll be copying a human trader. Whenever the selected trader enters a position, the same trade is replicated in your account. It’s also possible to create custom strategies from the ground up.

Most auto cryptocurrency trading sites are aimed at beginners, so you won’t need any programming experience. You can select which triggers the bot should follow, and it will execute your instructions like-for-like. Moreover, many platforms offer backtesting features, allowing you to try your strategy out on historical data before risking real capital. This can provide valuable insights into how your chosen technique might perform in live markets, enhancing decision-making. Just remember that no auto trading strategy guarantees profits. This is why starting off with a demo account is a wise option.

There are two different ways to access crypto auto trading platforms.

First, some of the best providers are third-party platforms that connect with exchanges. You’ll pay a monthly subscription fee and connect to your exchange accounts via an API. Alternatively, you can also access auto-trading strategies directly from selected exchanges. This means the bot must trade on that particular exchange, which can be a drawback.

In both scenarios, you’ll need to invest capital into the respective strategy. Orders will then be automated on your behalf via an automated bot or a copy trading tool. You’ll benefit from a passive trading experience, as you won’t need to perform any market research.

What’s more, you won’t have to place orders with an exchange. However, keep in mind that not all automated trading strategies make a profit. Diversification can reduce the risk of financial loss, meaning you invest in multiple strategies.

Let’s look at a quick example of how an automated trading strategy works:

There are many different options when researching crypto automated trading platforms.

Let’s explore some of the most common.

Copy trading is a great option if you don’t trust automated bots. Put simply, you’ll allocate capital to copying the portfolio of an experienced crypto trader. Anything they buy or sell will be replicated in your account. This means you can leverage the analysis skills of a proven investor from the comforts of home.

Here’s an example of how automated copy trading works:

Most copy trading providers utilize a profit-sharing commission. This means a percentage of profits are distributed to the trader. For example, suppose the commission is 10%. On a $50 profit, you’d keep $45, while $5 goes to the trader. This keeps the trader motivated and ensures they perform to the best of their abilities.

The most popular automated trading tools are bots. These are software-based and offer many benefits over human traders. For a start, bots can trade crypto all day, every day. They can usually monitor an unlimited number of trading pairs around the clock. This means bots never miss a trading opportunity.

For example, the bot might trade BTC/USD in the early morning and then ETH/USD during the night based on market changes, while a human might have been asleep by then. Bots are systematic, meaning they can only follow pre-programmed conditions. For instance, suppose the bot is programmed to trade Bitcoin based on the 200-day moving average. Irrespective of broader market conditions, it can only enter positions based on this indicator.

Although bots have been known to malfunction, the risks are vastly reduced when using risk management orders. For example, Dash 2 Trade supports stop-loss positions. This means the bot can only lose a certain amount on each trade. So, if a trade doesn’t go to plan, your bankroll won’t be depleted.

Crypto auto bots can usually be deployed on the most popular exchanges, such as Coinbase, KuCoin and Kraken. Bots are often compatible with the spot trading and futures markets. Although most traders opt for a pre-made strategy, you can also build one from scratch. This ensures the bot aligns with your risk appetite.

Trading signals are another popular way to automate your crypto investments. However, they’re not fully automated, as you’re still required to place orders manually.

Here’s how it works:

Signals come with benefits and drawbacks. The main advantage is that you can pre-vet trading suggestions rather than always following them blindly. You might find some signals unsuitable for your risk appetite, so you can simply ignore them.

However, you must be active to make the most of signals. Time delays can reduce the signal effectiveness, as some require immediate action.

I’ve established that there are many different types of automated crypto trading platforms. But how did I rank the top providers for this guide? I’ll now explain my research methods so that you can make an informed decision.

First, I explored how much automation the trading platform offers. For instance, some investors prefer a ‘plug-and-play’ solution, meaning the trading process is fully automated. Put otherwise, the bot will research the markets and place trading orders on your behalf. No manual input is required, so you can sit back and hopefully enjoy passive returns.

I also included automated crypto trading platforms that support custom strategies. This means you’ll need to spend time training the bot. This enables you to automate a proven strategy. For instance, you might be a scalping trader who leverages support and resistance levels, alongside the MACD and Bollinger Bands. A custom bot will automatically mirror your strategy.

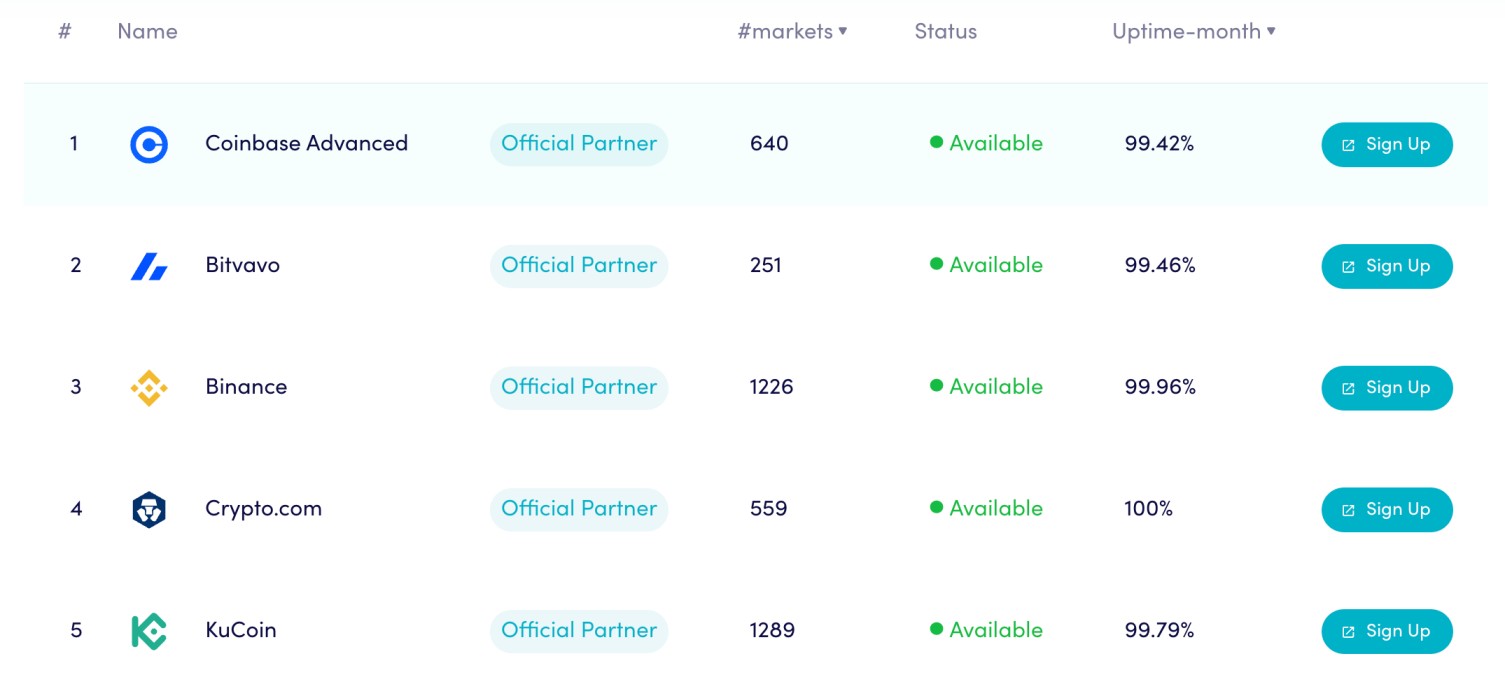

It’s also important to assess what exchanges the automated trading platform integrates with. I found that the best providers connect with leading exchanges like Binance, MEXC, KuCoin, Kraken, and Coinbase. You can connect your exchange account via an API key, which takes seconds to set up.

Additionally, evaluate which crypto markets the platform supports. For example, while a platform might support MEXC, this doesn’t mean it supports all 2,000+ markets. Instead, it might only support a selection of pairs. You should also assess whether you want to trade the crypto spot markets or derivatives like perpetual swaps and futures.

Some of the best automated crypto trading platforms support thousands of strategies. While having lots of choices is a plus point, choosing a strategy should be straightforward. I prefer platforms with a range of filters, allowing you to select the most suitable strategy for your goals.

I expect to see the following data points when reviewing strategies:

Having access to ample data points allows you to make an informed decision.

Past performance doesn’t guarantee future results. So you’ll want to choose an automated trading platform that enables you to test strategies before going live.

First, I prioritized platforms offering backtesting facilities. This enables you to test how strategies would have performed in past market conditions. You can often backtest several years’ worth of data in minutes, and amendments to the strategy can be made accordingly.

Second, I also prefer platforms offering demo trading facilities. This enables you to deploy a strategy in the live crypto markets with virtual funds. You’d want to run the strategy in demo mode for extended periods. This will yield the most effective data and results.

Fees will vary widely depending on the auto trading platform and the chosen strategy.

For example, if you opt for a crypto auto trading bot like Dash 2 Trade, you’ll pay a monthly subscription. You’re then free to connect the bot to any exchange. Alternatively, if you opt for an automated copy trading platform like PrimeXBT, no subscription fees are charged. However, you’ll need to enter a profit-sharing agreement with the trader.

This means you only pay fees on profitable trades. Expect to pay around 10-20% of the generated returns. Some platforms offer fee-free access to their automated strategies. The only requirement is that you cover standard trading commissions, which are often minute.

I also encountered platforms that charge a one-off fee. This fee gets you lifetime access to a bot, with no further charges required. However, it can also mean that the strategy developer has no motivation to make improvements.

Investors should also explore whether the platform offers a native mobile app. This enables you to keep tabs on the automated strategy without needing desktop access.

You can simply open the app and see how the bot or copy trader is performing. Most importantly, you should be able to activate or deactivate the strategy at the click of a button.

Safety should be considered when exploring automated crypto trading bots. For a start, the bot will require access to your trading capital. Otherwise, it won’t be able to enter positions on your behalf. If you’re using a third-party platform, you’ll need to obtain an API key from your crypto exchange.

This will be unique to your account. In general, this is a safe process. This is because the API key does not permit account withdrawals. On the contrary, it simply enables the bot to trade from your balance. However, just make sure you’re using a legitimate platform; fraudsters have been known to use crypto bots to drain account balances.

There might also be a fear that the bot malfunctions and trades the account to zero. Fortunately, platforms like Dash 2 Trade offer in-built risk management tools. For example, the bot can automatically close a position if it declines by 2%. This protects your capital over time. You can set the stop-loss percentage based on your risk appetite.

The objective when auto-trading crypto is simple: generate long-term profits without actively researching the market. However, if it were this simple, we’d all have accounts with automated trading platforms. The reality is that while some automated strategies make money, others don’t.

This is why researching the best strategies is so important. For example, you might come across a strategy that has made 30-day gains of 200%. However, upon closer inspection, you might find that the bot has only been operating for 45 days. This isn’t enough data to make an informed decision.

Instead, it’s best to focus on strategies that have a proven track record over extended periods. The longer, the better. And don’t forget about backtesting and demo trading. These tools will enable you to test an automated strategy without risking any funds. Even if your strategy is profitable, you should still monitor its performance regularly.

Another mistake made by beginners is going ‘all in’ on one trading strategy. If you’re interested in copy trading, ensure you’re copying multiple traders. The same goes for automated trading bots and signals. Ultimately, ensure you’ve considered the risks before proceeding; there’s no guarantee you’ll make money.

In summary, I’ve revealed the best automated crypto trading platforms for 2025. The best option for beginners is Dash 2 Trade, which offers a plug-and-play trading bot that connects with the most popular crypto exchanges.

There are multiple strategies to choose from, each comes with in-built risk management tools. Most importantly, Dash 2 Trade offers demo trading facilities, so you can test strategies without risking any capital.

Visit Dash 2 Trade

See also:

References

“U.S. Charges KuCoin Crypto Exchange with Anti-Money Laundering Failures.” Reuters, 26 Mar. 2024, www.reuters.com/technology/us-charges-kucoin-crypto-exchange-with-anti-money-laundering-failures-2024-03-26/

“Technical Analysis.” CFA Institute, www.cfainstitute.org/en/membership/professional-development/refresher-readings/technical-analysis

“When and Why to Use API Keys.” Google Cloud, Why and when to use API keys | Cloud Endpoints with OpenAPI | Google Cloud

“Crypto Fraudsters Use Robocalls to Drain Accounts.” CNBC, 15 Feb. 2022, www.cnbc.com/2022/02/15/crypto-fraudsters-use-robocalls-to-drain-accounts.html

Can you automate crypto trading?

Yes, many platforms support automated crypto trading. Options often include fully automated bots, signals, or copy trading.

What types of tools do the best automated crypto trading platforms offer?

The best platforms offer trading bots, copy trading, rule-based strategies, and market signals. They also provide risk management tools like stop-loss orders and backtesting to test strategies before using real money.

Is it legal to automate crypto trading?

Yes, regulators and exchanges treat automated crypto trading the same as manual investing. There are no restrictions or legal issues.

Is auto crypto trading worth it?

Yes, auto crypto trading enables you to deploy multiple strategies 24/7. However, not all automated strategies are profitable, so ensure you consider the risks.

What are the risks of using a crypto trading bot?

Trading bots can malfunction, follow bad strategies, or lose money in unpredictable markets. Some shady platforms may also misuse API access, so it’s important to choose a trusted service.

What is the success rate of crypto trading bots?

The success rate of crypto trading bots varies considerably. While some make consistent profits, others lose money.

What is the difference between a crypto exchange and a brokerage?

A crypto exchange lets users trade directly with others, usually at lower fees. A brokerage, on the other hand, acts as a middleman, offering fixed prices but often charging higher fees.

What is the best automated crypto trading platform?

Dash 2 Trade is the best option for fully automated trading bots. On the other hand, if you want to build a custom bot from scratch, check out Cryptohopper.

Which cryptocurrency exchange is best for beginners?

Binance is a great exchange for beginners because it has an easy-to-use interface, a wide range of cryptocurrencies, and low trading fees. MEXC is another good choice, especially for those interested in copy trading and automated tools.

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

Weekly Research

Monthly readers

Expert contributors

Crypto Projects Reviewed

Having delved into futures trading in the past, my intrigue in financial, economic, and political affairs eventually led me to a striking realization: the current debt-based fiat system is fundamentally flawed. This revelation prompted me to explore alternative avenues, including… Read More

Maximize Your Trading With Margex’s 20% Deposit Bonus

Hottest Meme Coins to Buy in April? Retail Target Latest Crypto For Mega Gains

AR.IO Brings The Permanent Cloud to AI Storage Crisis

10 Best Crypto Bonuses in 2025 – Top Exchange Offers & Promotions

BingX Launches $10 Risk-Free Copy Trading Voucher for New Users in Exclusive Event

10 Best Crypto Bonuses in 2025 – Top Exchange Offers & Promotions

What is Arbitrum: A Beginner’s Guide to ARB

What is Hedera? A Beginner’s Guide to HBAR

What is Algorand? A Beginner’s Guide to ALGO

What is Internet Computer (ICP)? A Beginner’s Guide

What is Optimism? A Beginner’s Guide to OP Tokens

Let’s get social

© 2025 99bitcoins LTD, All rights reserved

Stay ahead with the latest updates, exclusive offers, and expert insights! Sign up for our newsletter today and never miss a beat.