As a crypto beginner, one of the most important decisions is the cryptocurrency exchange that you choose to trade on. Choosing the right crypto trading platform will help you make the most of your trading journey.

However, with many crypto trading platforms on the market, choosing the best cryptocurrency platform can be challenging for newbies. In this guide, we review the best crypto trading platform for beginner traders and investors. These crypto trading platforms offer low fees, simple trading experience, high security, and access to the most popular assets.

Below, we briefly highlight the best crypto exchanges on our list to help you understand their major offerings.

In the following section, we go into a detailed analysis of the best crypto trading platforms we rank in this review, including their features, fees, and asset support.

Similar to Bitstamp, eToro offers high liquidity across its spot and derivatives trading markets, making it a reliable crypto trading platform for low and high-volume investors.

On eToro, investors can buy, sell, trade, and exchange 80 top-market cryptocurrencies, including Bitcoin, Ethereum, Bitcoin Cash, Ripple, and other altcoins. Investors can also access thousands of other digital assets like stocks, forex, and exchange-traded funds (ETFs).

Despite its numerous features, what stands out the most about eToro is its copy trading. With the platform’s innovative CopyTrader, beginners can mirror trades from expert traders and leverage their moves or trading strategies for more potential profit. As such, beginners can automatically copy trades from top investors to make better trading decisions. This makes eToro one of the best social trading apps to consider in 2025.

The minimum deposit on eToro is $10, and you can buy crypto for as low as $1. The exchange charges a flat 1% fee for crypto transactions.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

Cryptoassets are highly volatile and unregulated in the US and UK. No consumer protection. Tax on profits may apply.

Cryptoassets are highly volatile and unregulated in the US and UK. No consumer protection. Tax on profits may apply.

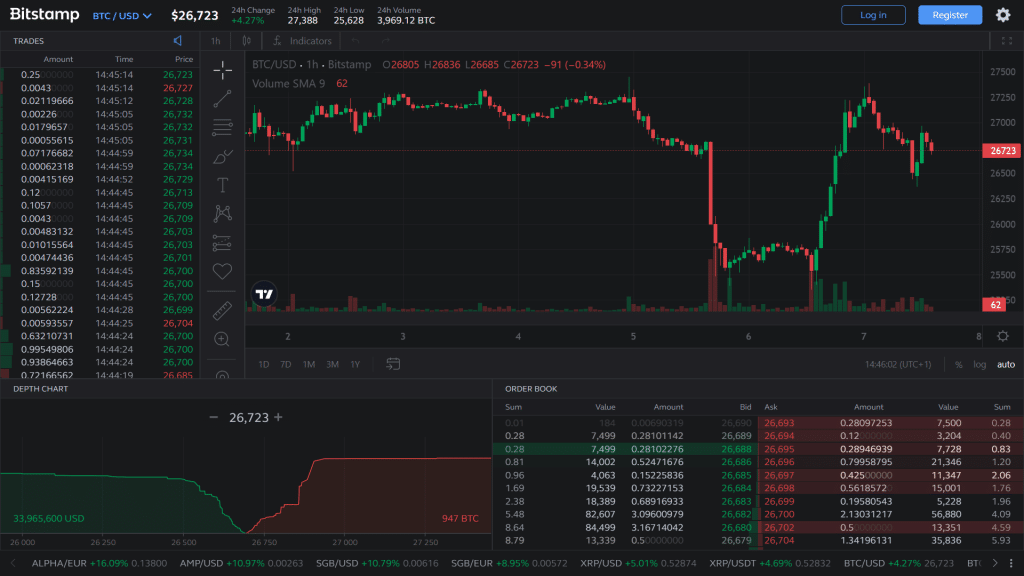

According to CoinMarketCap, Bitstamp ranks 7th among the best crypto exchanges in terms of liquidity. At the time of writing, the exchange has a 24-hour trading volume of $288,303,276.92 (equivalent to 11,207 BTC).

Beyond its reputation, Bitstamp allows users to buy, sell, and trade 80+ cryptocurrencies, including some of the best cryptos like Bitcoin, Ethereum, Tether, Ripple, Polygon, etc.

However, one of Bitstamp’s most notable features is its security. The exchange boasts institutional-grade security, with 95% of its assets in offline cold storage. Similarly, the exchange deploys high-level encryption technology and offers safe transactions.

The minimum deposit on Bitstamp is $10 or its equivalent, making it suitable for beginners. Bitstamp fees are also among the lowest on the market. The exchange charges a maker fee between 0.00% and 0.30% and a taker fee from 0.00% to 0.40% – depending on users’ monthly trading volume.

Your capital is at risk.

In terms of liquidity, OKX sits on the 5th spot, according to CoinMarketCap, with a 24-hour spot trading volume of $1,596,162,962.88 (equivalent to 62,140 BTC) at the time of writing.

OKX’s high liquidity is due to its support for a wide range of crypto assets and DeFi coins. The exchange supports 360 cryptocurrencies, including Bitcoin, Ethereum, and low-market altcoins like Monero, Chainlink, Stellar, Kine Protocol, etc. Experienced traders will also find over 500 trading pairs in the spot and derivatives markets.

Like other platforms on our list of the best crypto exchanges, OKX offers simplified buying and selling of crypto using a simple buy and sell feature. Experienced investors can also access non-fungible tokens (NFTs) and other promising DeFi projects.

On top of that, the exchange offers various earn features, including crypto staking, decentralized finance (DeFi) lending and borrowing, etc. Interestingly, investors can get up to 319% annual percentage yield (APY) on staking products.

The minimum deposit on OKX is $10, with access to fractional coins for as low as $1. OKX charges a maker fee between -0.005% to 0.080% and a taker fee ranging from 0.020% to 0.100% depending on customers’ 30-day trading volumes.

CoinMarketCap ranks Coinbase as the second-best crypto exchange in terms of liquidity – just a spot behind the global Binance exchange. With a 24-hour spot trading volume of $1,352,853,632.01(equivalent to 52,955 BTC) at press time, Coinbase remains a high-liquidity exchange for retail and institutional investors.

On Coinbase, investors can buy and sell over 10,000+ assets, including Bitcoin, Dogecoin, Ethereum, Binance Coin, Tether, and thousands of the best altcoins on the market. In addition, there are over 530 crypto-to-crypto and crypto-to-fiat trading pairs for trading in advanced markets.

At its core, Coinbase strives to offer simplified trading to customers. Beginners can buy and sell cryptocurrencies and other assets without the complexities associated with other best crypto exchanges – thanks to its simple trading platform. Customers who want a more sophisticated platform with advanced trading tools can opt for the Coinbase Pro platform.

The minimum amount required to buy crypto on Coinbase is $2. Coinbase trading fees range from 0.00% to 0.40% for makers and 0.05% to 0.60% for takers.

The Crypto.com exchange currently ranks 22nd in terms of global trading volume for centralized exchanges (CEXs) by CoinMarketCap. At the time of writing, the exchange has a 24-hour spot trading volume of $129,967,898.58 (equivalent to 5,093 BTC), which is lower compared to Coinbase, Bitstamp, and OKX.

Trading on Crypto.com is pretty straightforward via the website or sophisticated Crypto.com app. The company also offers strong security, including a 100% cold storage of customers’ assets and an insurance fund worth $750 million.

Crypto.com uses a maker-taker fee model. The exchange charges a flat 0.075% fee for makers and takers, one of the lowest on the market. However, customers who stake CRO get discounted trading fees, depending on their staked amounts.

Since CEXs have various restrictions, including mandatory identity verification (or KYC), some traders prefer to transact on decentralized exchanges (DEXs), as they require no KYC.

We review the best two DEXs for beginners below.

PancakeSwap is largely considered to be the best DEX around the globe. The platform handles around $1.9 million in funds and launched in 2020 . The DEX is built on the Binance Smart Chain network which offers fast speeds and low fees. Although the platform is built on the Binance chain, it uses bridges to wrap non-BEP20 tokens so that users can trade a variety of DeFi coins such as LBLOCK, IBAT and APE.

As well as crypto trading, PancakeSwap offers a lucrative staking feature through which crypto holders can earn passive income from their investments. Traders can stake through pools, farms or liquid staking. Users can also invest early in new projects through the Initial Farm Offering feature- this provides access to new crypto projects that can be purchased with LP tokens. All projects are vetted by the Binance team before they are launched on the platform.

It is also possible to earn through the PanckaeSwap lottery feature which runs twice each day. Traders can enter by purchasing tickets with crypto. If they win, they will be rewarded with 40% of the prize pool. Traders can also access NFTs through PancakeSwap; this feature was launched in 2021 and experienced $3.6 million in trading volume on day one.

PancakeSwap was created to lower fees and improve transaction speeds. As a result, the DEX is very popular amongst traders. The platform is compatible with a number of the best DeFi wallets including MetaMask, Trust Wallet and Wallet Connect. Traders can also connect a Ledger hardware wallet to the DEX.

According to CoinMarketCap, Uniswap v2 has a 24-hour spot trading volume of $136,683,794.74 (equivalent to 5,265 BTC). Similarly, the Uniswap v3 has a volume of $903,400,739.89 (or 34,735 BTC) within the same period. That means Uniswap would rank among the most liquid CEX if it weren’t decentralized.

On Uniswap, investors will find over 1000 coins and 1800+ trading pairs. The platform is also easy to use for buying, selling, and swapping Ethereum and hundreds of ERC-20 tokens. Uniswap also has its proprietary token called UNI with real utility, including fee payment and governance.

The minimum deposit on Uniswap depends on the coin you’re swapping. The exchange charges a 0.3% fee for all crypto swaps on its trading platform.

Centralized and decentralized crypto exchanges both exist to offer crypto traders a platform to buy, sell, swap, or invest in cryptocurrencies. However, both kinds of exchanges differ in their core offerings.

As the name implies, a centralized exchange (CEX) is controlled or regulated by a third-party body or authority. As such, it offers users less control over their assets. On the other hand, decentralized exchanges (DEX) offer users more control because they use peer-to-peer trading systems that do not require intermediaries or regulatory authority.

In addition, decentralized exchanges offer low transaction fees compared to centralized exchanges. For example, a DEX like UniSwap charges a 0.30% transaction fee, which is lower than what’s obtainable on many CEXs.

Conversely, CEXs offer faster transactions, higher liquidity, and simpler usability. These factors play a major role in determining the suitable exchange for you.

Your money is at risk.

Based on our detailed research, the best cryptocurrency trading platform for beginners is Bitstamp. The exchange offers a simple trading interface across its website and mobile app. Similarly, it offers competitive trading fees, high liquidity, and high-level security. However, exchanges like Coinbase, eToro, and Crypto.com are also ideal for crypto beginners.

Read more: Best crypto presales to invest.

The Cheapest crypto trading platform in 2025 is PancakeSwap. The best decentralized exchange charges trading fees of just 0.25% which is considerably lower than many other platforms on the market. As a decentralized exchange, there are no account management fees involved with using PancakeSwap. The only fees applicable are those involved with trading.

Below, we compare the best crypto trading platforms to see how they stack against one another.

Taker fee: 0.00% to 0.40%

Taker fee: 0.020% to 0.100%

Taker fee: 0.05% to 0.60%

Your capital is at risk.

When it comes to finding the best crypto exchange for Bitcoin traders, Bitstamp stands out as an excellent choice. Bitstamp offers a comprehensive platform that caters to the needs of both novice and experienced traders. With its reliable and secure infrastructure, Bitstamp allows users to seamlessly buy, sell, and trade Bitcoin in both the spot and derivatives markets.

Aside from its trading and lending capabilities, Bitstamp prides itself on being user-friendly. The platform is designed to offer a smooth and intuitive experience, making it accessible for traders of all levels of expertise. Whether you are a seasoned trader or just starting out, Bitstamp’s user-friendly interface allows you to easily navigate the platform, ensuring a hassle-free trading experience.

Read more: Best meme coins to invest.

The platforms mentioned above are all great options for crypto trading. However, there are plenty of other platforms available that are worth looking into before making a final decision. Here are the key factors to consider to identify the best crypto exchanges.

The first thing to check is the trading fee on the platform. The best Bitcoin trading platform offers low fees that provide a large chunk of your profits after deduction.

The availability of multiple cryptocurrencies on a trading platform will help you diversify your portfolio and offer you more potential profits. The more the assets supported, the better the trading and investing opportunities.

With the proper analysis tools, you can make informed trading decisions and mitigate the risk of losses due to volatility. That means trading on exchanges like eToro and Bitstamp with advanced market analysis tools will give you an edge.

Exchanges like eToro offer auto trading tools for beginners to leverage crypto trading bots instead of manual trading. This helps reduce the risk of human errors and offers more potential rewards. For instance, you can automatically copy trades of professional traders using the CopyTrader feature on eToro.

Whether you’re a beginner or a seasoned trader, the best way to improve your crypto knowledge and trading skills is by reading more. The best exchanges offer easy-to-understand educational resources to help you achieve this.

For traders using self-custodial or third-party wallets like MetaMask and Wallet Connect, it’s imperative that you trade or buy crypto on exchanges that support the same network as the decentralized wallet. Look out for this information before registering at any exchange.

The best exchanges offer diverse payment methods to make deposits and withdrawals seamless for their customers. These include crypto, credit/debit card, bank transfer, wire, and e-wallets. For instance, Bitstamp, our best Bitcoin trading platform, supports crypto and fiat payment methods, including direct USD payments.

Since you can get stuck while trading on an exchange, it’s vital to opt for exchanges for responsive customer support to help resolve issues whenever they arise. The best exchanges offer 24/7 customer support via email, phone, and live chat.

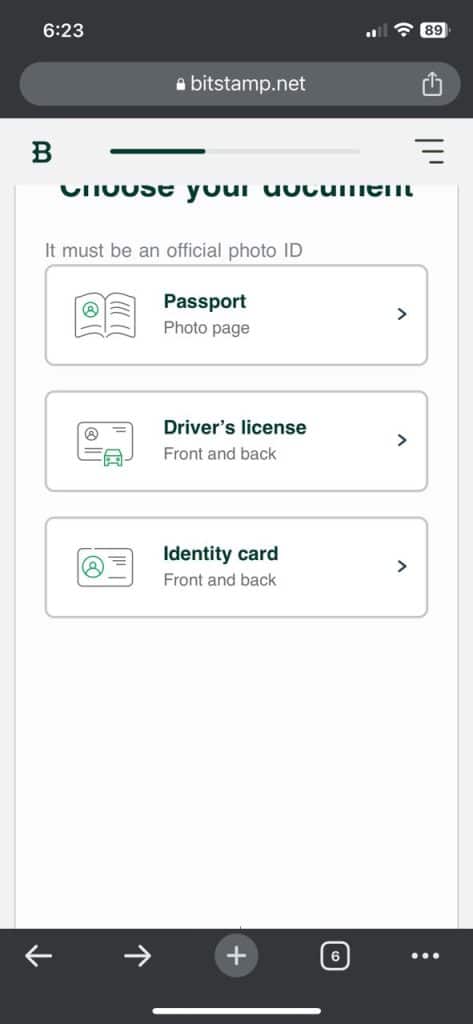

Finally, you should assess an exchange’s security features before creating an account. A safe exchange is usually regulated by a reputable body, such as a securities and exchange commission. Similarly, the exchange deploys security measures like cold asset storage, high-level encryption, two-factor authentication (2FA), insurance fund, etc.

Your capital is at risk.

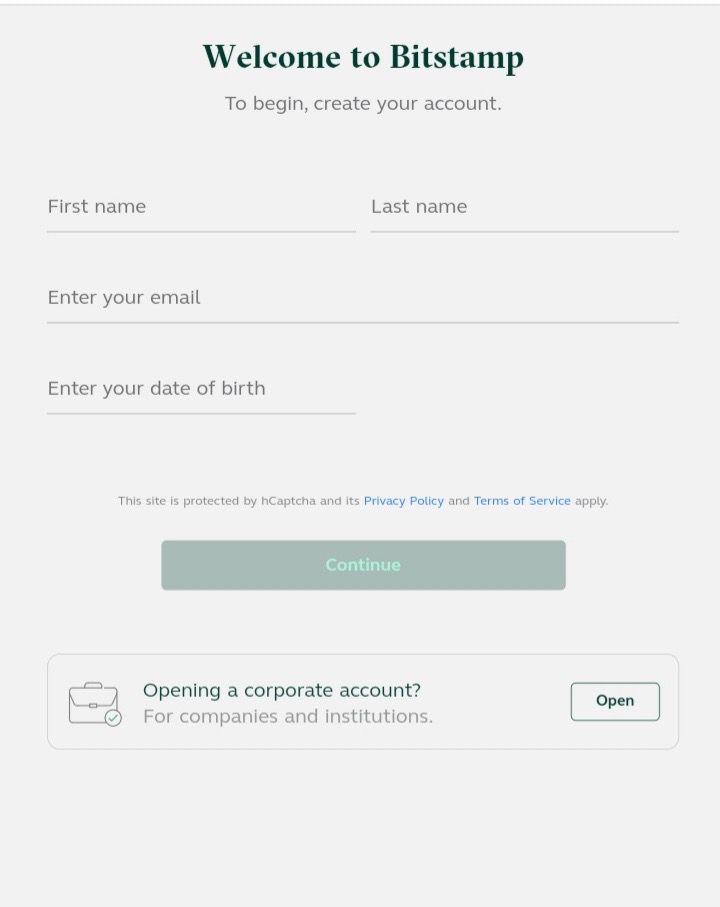

As stated earlier, Bitstamp, our best crypto trading platform, offers simple trading via its website and mobile app. Getting started on Bitstamp is pretty straightforward using the steps below.

Since it’s advisable to diversify your investment portfolio, explore diverse crypto options and learn about them. Understand the best times to buy, sell, or HODL these assets and make informed decisions.

Once you’re confident in your trading skills, navigate the Bitstamp exchange and start trading.

Read more: Best AI Stock Trading App.

With hundreds of cryptocurrency exchanges on the market, finding the best crypto trading platform for beginners can be challenging. We’ve reviewed five of the best Bitcoin trading platforms in this guide to help you.

In conclusion, eToro is the overall best crypto trading platform for beginners in 2025. The exchange offers simplified trading, access to 80+ assets, low fees, earn features, and high-grade security.

Your capital is at risk.

Looking to invest in the next 100x crypto? Be sure to check out these promising crypto projects:

The biggest crypto exchanges allow traders to buy and sell Bitcoin and other cryptocurrencies easily. These include Bitstamp, eToro, Coinbase, OKX, and Crypto.com.

The best crypto exchanges for US residents include Coinbase, BinanceUS, and Kraken. These exchanges are regulated and legal in the US.

Yes, you can trade crypto on your phone. The best crypto trading platforms offer mobile applications for users to trade on the go.

The cheapest crypto trading platform is PancakeSwap. The exchange charges low trading fees of just 0.25%.

The best Bitcoin trading app is the Coinbase app. The app offers an intuitive and highly-responsive interface with simplified crypto trading features.

stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2025