Close search

By Jose Aquino

Last Updated: Apr 16, 2025

Co-author

By Caroline

Fiat-to-crypto exchanges let investors deposit local currencies or purchase digital assets instantly with credit cards and e-wallets. Some platforms also support fiat withdrawals to bank accounts, enabling users to sell crypto investments for traditional currencies like USD and EUR.

This guide ranks and reviews the best online exchanges for fiat-to-crypto transfers, focusing on core factors like fees, accepted payment methods, and KYC requirements. Read on to learn how to buy, sell, and trade digital assets with fiat money in 2025.

Here are the best fiat-to-crypto exchanges for investors in 2025:

The top fiat-to-Bitcoin exchanges will now be reviewed in full. Read on to make an informed choice.

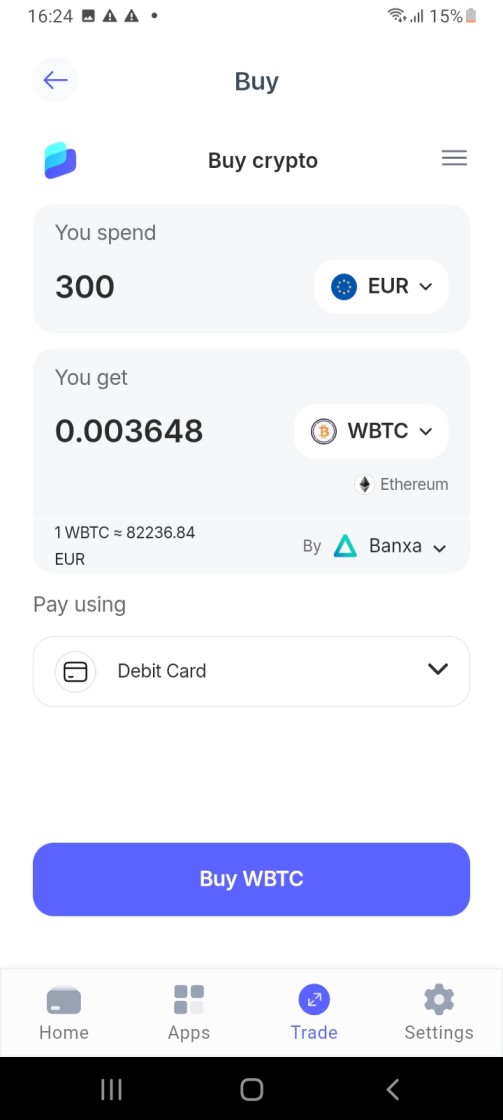

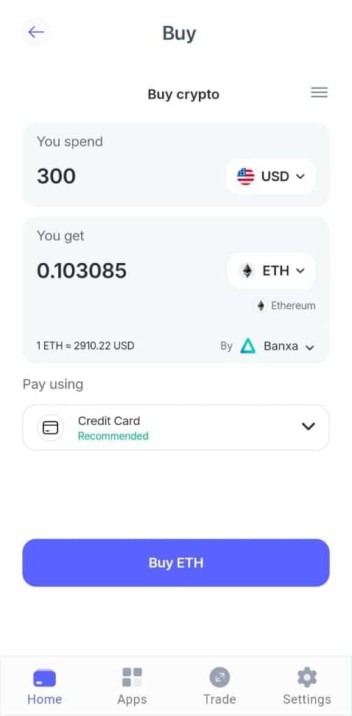

In our view, Best Wallet is the best crypto-to-fiat exchange in the market. It’s a non-custodial app that offers wallet and exchange services in one safe, decentralized environment.

The app supports millions of tokens from 60 networks, including Ethereum, BNB Chain, Solana, Arbitrum, Polygon, and Base. Users can purchase cryptocurrencies with local currencies and payment methods — common options include credit cards, PayPal, Google/Apple Pay, and domestic bank transfers.

Best Wallet allows users to sell digital assets for fiat currency, too, making it a one-stop shop for all crypto trading needs. Transfers are typically sent via bank wire, but other options are sometimes available, depending on the available gateway.

In terms of fees, Best Wallet uses an aggregator system, so it sources market-leading prices from liquidity providers. Those charges are built into the exchange rate, giving users enough time to assess competitiveness. Most fiat partners support anonymity up to various amounts, so Best Wallet is a great choice for avoiding KYC processes.

Pros

Cons

Visit Best Wallet

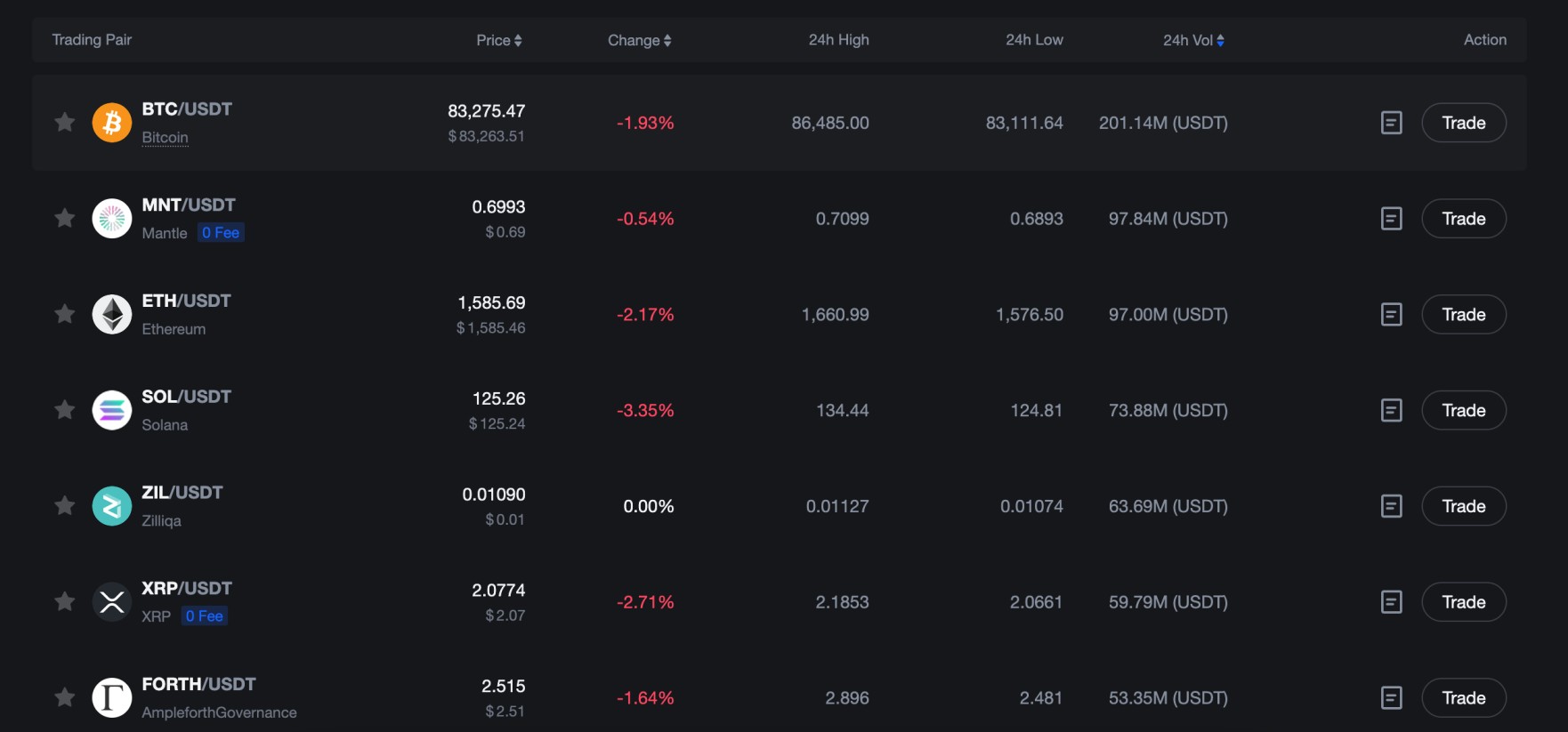

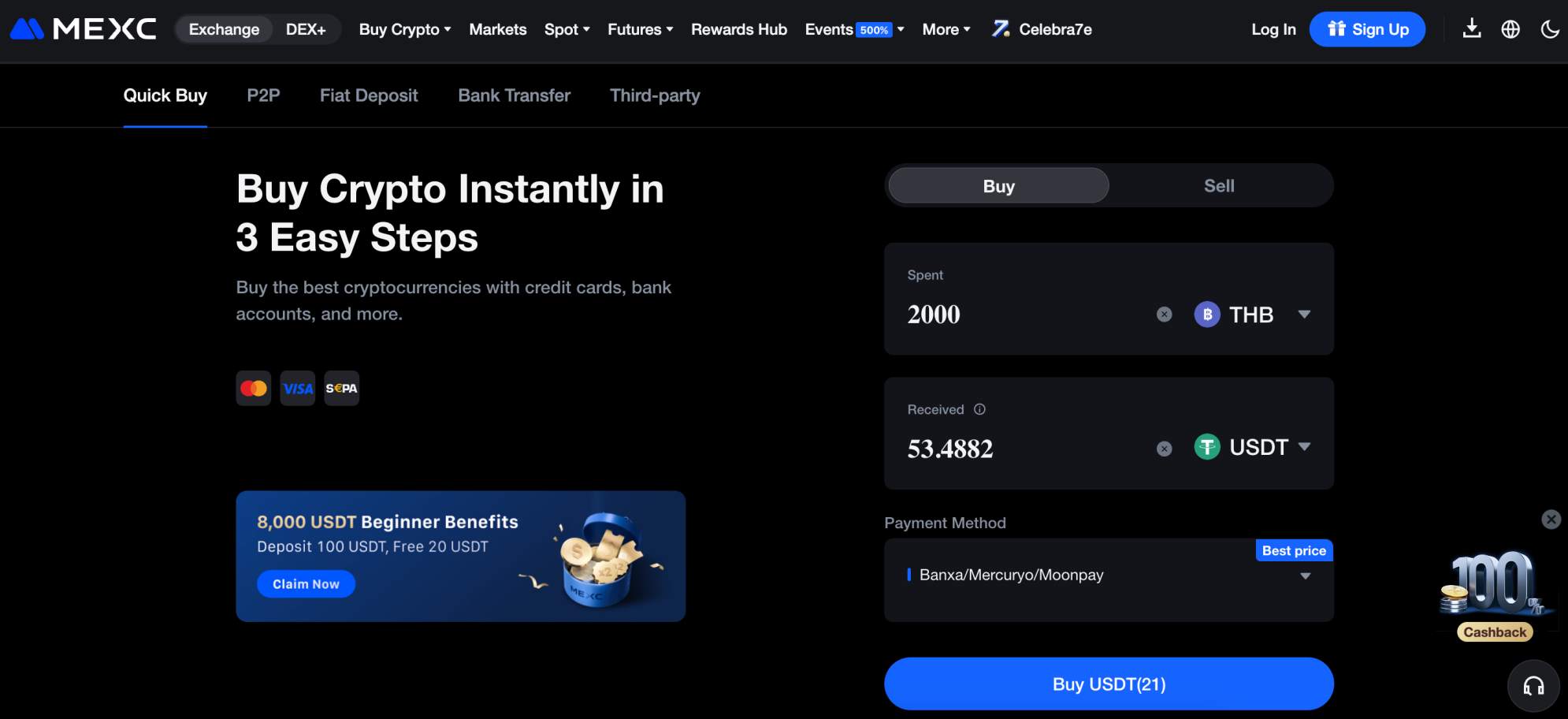

MEXC, considered one of the best no KYC crypto exchanges, has partnered with the world’s leading gateways to offer instant crypto purchases. The platform accepts Visa, MasterCard, and SEPA, and currencies range from EUR and USD to TRY, BRL, and THB. Users can buy popular cryptocurrencies like Bitcoin, Ethereum, TRON, and XRP. USDT is the best option for those who plan to trade cryptocurrencies on MEXC — over 4,000 markets are paired with the stablecoin.

Payment fees, while typically competitive, are built into the quoted rate like many fiat-to-crypto exchanges. Minimum deposits generally start at $10 or the currency equivalent, making MEXC a good option for crypto beginners.

The platform also lets users sell cryptocurrencies for fiat — a feature that launched recently. Third-party processors like MoonPay and Mercuryo process fiat currency withdrawals, so fees will vary. KYC requirements also depend on the gateway — some offer anonymous fiat payouts, although limits depend on the user’s country of residence and the payment method.

Pros

Cons

Visit MEXC

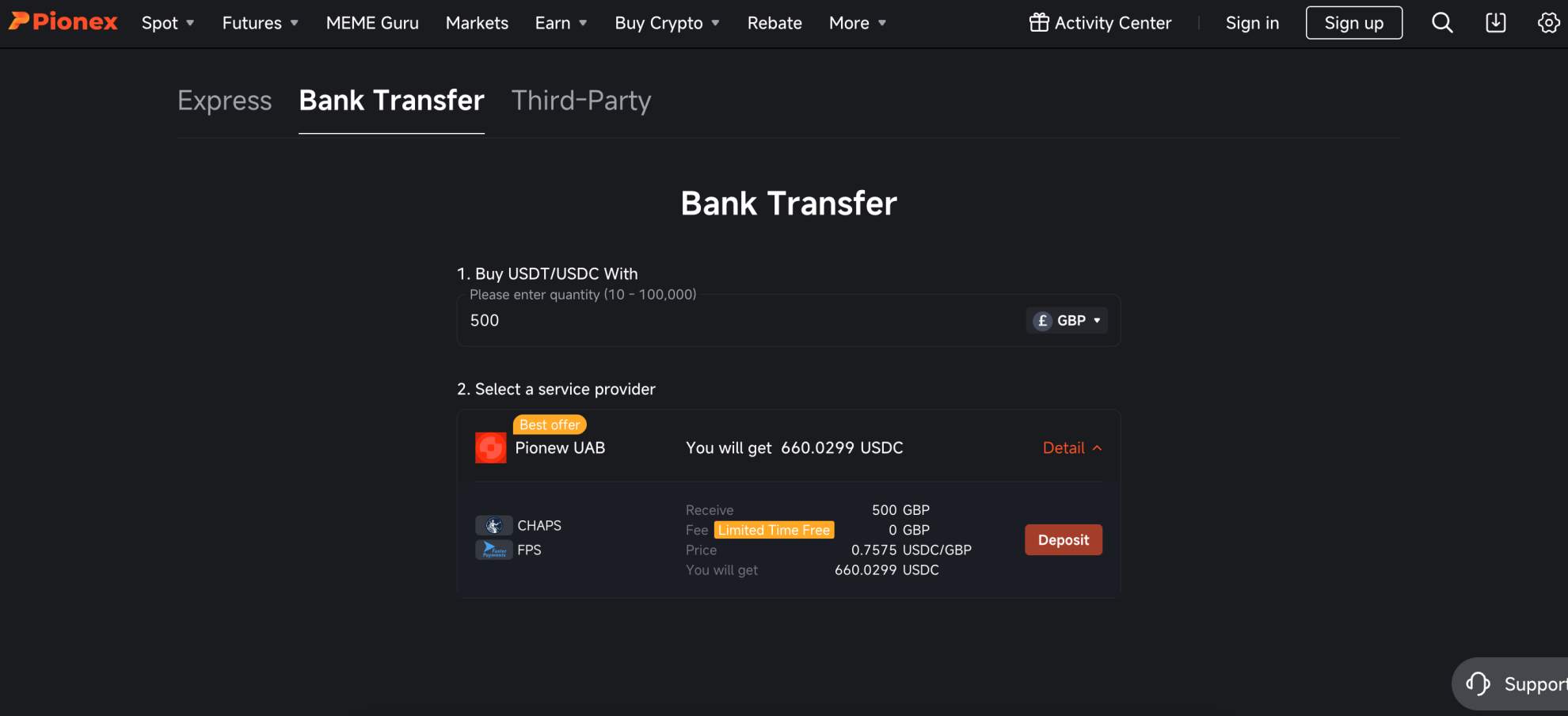

Pionex is a regulated crypto platform that specializes in trading bots, which allow users to buy and sell digital currencies through automated strategies. The platform is also one of the top fiat-to-crypto exchanges — UK and European users can purchase USDC via bank transfer without paying fees. The provided exchange rate is often market-leading, too. A £500 payment gets 660.02 USDC, which is practically identical to global spot rates.

Pionex supports multiple banking networks, including SEPA, SEPA Instant, Faster Payments, and CHAPS. Payment timeframes range from near-instant to several days, depending on the chosen method. Payment limits range from £/€ 10 to £/€ 100,000, so both casual investors and crypto whales are catered to. Note that Pionex also accepts debit/credit cards, but payments are processed by third parties, so expect high fees.

After buying crypto with fiat currency, users can withdraw their digital assets to a private wallet. Withdrawal fees depend on the digital currencies (e.g. Bitcoin costs 0.000007 BTC). Users can also trade hundreds of cryptocurrencies to build a diversified portfolio.

Pros

Cons

Visit Pionex

Founded in 2011, Kraken is one of the oldest and most trusted crypto exchanges in the industry. It’s regulated in the US and licensed in all states apart from Washington, Maine, and New York. US clients can deposit funds via ACH payments, with funds arriving in the Kraken account almost instantly. The minimum ACH deposit is just $1, and no transaction fees apply.

Once the funds arrive, users have access to hundreds of regulated crypto markets — all traded in US dollars rather than stablecoins like USDT. Kraken is also one of the top fiat-to-crypto exchanges for withdrawals. ACH payouts, which are fee-free, arrive on the same day, when the request is made during the week.

Note that Kraken is also available in other countries, including the European Union, the UK, Canada, Switzerland, Japan, and Australia. Local banking methods are supported, usually without charge. Most Kraken users can buy cryptocurrencies with Visa and MasterCard, too, but fees are higher at 1.5% (including the trading commission).

Pros

Cons

Visit Kraken

Margex is a global crypto exchange that offers leveraged derivative products. Users can go long or short on perpetual futures markets with a minimum margin requirement of just 1%. This high-leverage framework provides $10,000 worth of market exposure with just $100.

The platform also supports fiat currency purchases, and over 150 payment methods are accepted — this includes debit/credit cards and e-wallets like Google/Apple Pay. Margex supports the best cryptocurrencies to buy, ranging from Bitcoin and TRON to Ethereum, Chainlink, and BNB. Stablecoins, including USDT, USDC, and TUSD, are supported, too.

After buying crypto with fiat, users have many options, including access to the derivatives portal and copy trading services. Competitive staking rewards of up to 7% are available, and the funds can be used as collateral for margin positions.

The exchange allows traders to withdraw cryptocurrencies to a private wallet. Margex processes payouts between 1:00 and 14:00 UTC daily for added security.

Pros

Cons

Visit Margex

Launched in 2017, Binance is the world’s largest crypto exchange in terms of trading volume. It offers institutional-grade liquidity, with billions of dollars flowing through the platform daily. Users get industry-leading spreads and spot prices, making it a great choice for large investments.

Although Binance accepts traditional payments, deposit and withdrawal fees can vary widely depending on the country. European traders can buy crypto with fiat instantly via Visa, MasterCard, and Apple/Google Pay at a 2% transaction fee.

SEPA payments are much cheaper at just €1, no matter the transfer size. Users in some countries can make payments via online banking, including Indonesia and the Philippines. Binance uses third-party gateways to bypass regulatory restrictions in some jurisdictions.

Users have access to Binance’s ever-growing ecosystem after fiat purchases are processed. It offers spot trading markets with hundreds of cryptocurrencies, and commissions are capped at 0.1%. DeFi features are also available, ranging from dual investments and staking to secured loans. Since the platform’s money laundering charges by the U.S. DoJ, Binance now has strict KYC requirements for all account holders.

Pros

Cons

Visit Binance

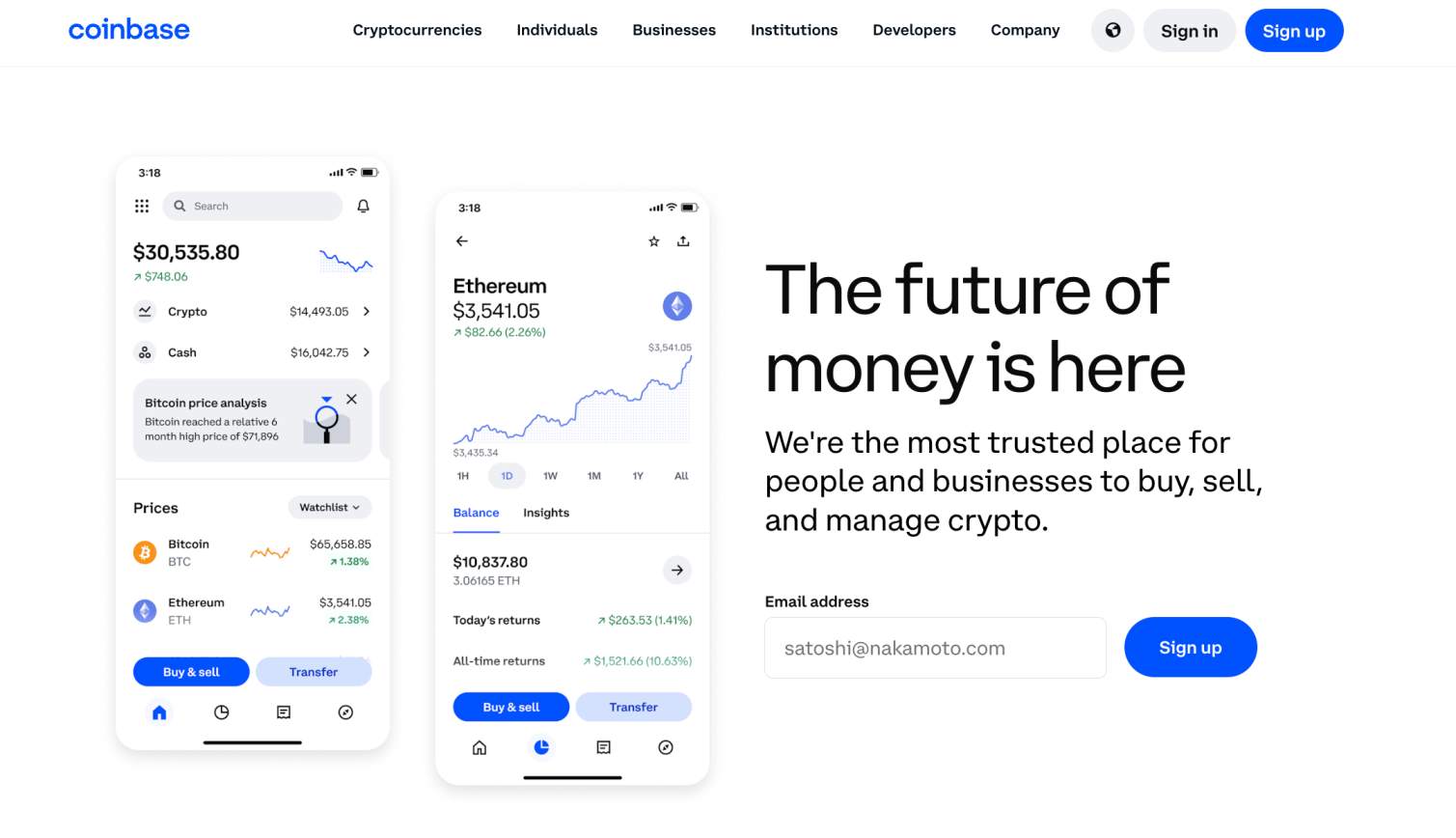

Coinbase is an established crypto exchange with over 100 million onboarded customers — this means all platform users have verified their identity through KYC, allowing them to buy digital currencies with fiat currency.

The platform holds licenses in multiple countries and regions, including the US, the UK, Italy, Poland, Canada, and Switzerland. Coinbase also offers robust security features — the exchange keeps most client funds in multisig cold wallets, and two-factor authentication is mandatory.

While Coinbase is also popular with institutional investors, its core customer base is retail clients. The exchange offers a user-friendly dashboard available on desktop browsers and smartphones. Users don’t require prior experience to buy and sell cryptocurrencies, and account minimums are a few US dollars or the currency equivalent.

Coinbase offers instant buy features with debit/credit cards and PayPal. Transaction charges are 3.99% of the purchase size, or a variable flat fee on orders below $200. Investors can avoid these high trading fees by using a bank account transfer, which is free and near-instant when using ACH, UK Faster Payments, and other common networks. Coinbase offers fee-free fiat currency withdrawals, too.

Pros

Cons

Visit Coinbase

What is a Fiat-to-Crypto Exchange?

Fiat-to-crypto exchanges let users buy digital assets with traditional currencies like USD, EUR, and AUD. These platforms accept convenient payment methods such as debit/credit cards, e-wallets, and local bank transfers, making it seamless for beginners to invest in crypto.

Most platforms have strict know-your-customer (KYC) processes when using fiat currency, which is due to banking and anti-money laundering regulations. The KYC process often involves uploading a government-issued ID and proof of residency, like a bank or credit card statement. Some providers, such as offshore no-KYC exchanges, offer anonymous fiat purchases, but payment amounts are often limited.

Crypto investors can sometimes convert crypto back into local currencies via bank wire or e-wallet transfers. Fiat capabilities can vary significantly depending on the platform, currency, and payment type, so users are encouraged to conduct independent research.

Types of Crypto Exchanges

Fiat-to-crypto exchanges let users buy digital assets with traditional currencies like USD, EUR, and AUD. These platforms accept convenient payment methods such as debit/credit cards, e-wallets, and local bank transfers, making it seamless for beginners to invest in crypto.

Most platforms have strict know-your-customer (KYC) processes when using fiat currency, which is due to banking and anti-money laundering regulations. The KYC process often involves uploading a government-issued ID and proof of residency, like a bank or credit card statement. Some providers, such as offshore no-KYC exchanges, offer anonymous fiat purchases, but payment amounts are often limited.

Crypto investors can sometimes convert crypto back into local currencies via bank wire or e-wallet transfers. Fiat capabilities can vary significantly depending on the platform, currency, and payment type, so users are encouraged to conduct independent research.

Traders have several options when they buy cryptocurrency with fiat money. Let’s break down the most common exchange types that accept everyday payment methods.

Crypto brokers offer one of the easiest ways to buy and sell digital assets with local currency. These platforms are often regulated, and examples include Coinbase (which is also an exchange), Robinhood, eToro, and Webull.

Brokers can directly accept fiat payments, so there’s no reliance on third-party gateways like traditional exchanges. Users purchase cryptocurrencies directly from the broker, which holds digital assets in custodial wallets.

The investing process is similar to using a stockbroker — users open an account, deposit funds, and place orders to buy their preferred assets.

Brokers, due to their strong licensing framework, also facilitate fiat currency withdrawals. Account holders sell their cryptocurrencies back to the broker and withdraw the proceeds to a bank account.

The world’s biggest crypto exchanges specialize in spot trading markets, where traders buy and sell digital assets “on the spot.” They use conventional order books to match market participants, and prices are determined by demand and supply.

Some spot exchanges double as brokers, including Coinbase, Kraken, and Gemini. They enable users to deposit local currencies directly into their exchange account, which can then be used to buy cryptocurrencies manually. This method is ideal for dollar-cost averaging as many exchanges offer a recurring buy feature.

The best crypto-to-fiat exchanges also offer instant purchases with debit/credit cards and e-wallets. Investors fill out an order form by entering the required crypto and amount, and the payment is credited instantly. The purchased cryptocurrencies appear in the user’s web wallet right away.

The best Bitcoin wallets come integrated with fiat gateways. These are third-party payment processors that specialize in fiat-to-crypto payments, allowing users to buy and store digital assets in one safe place.

Best Wallet, a popular crypto app with non-custodial storage, sources the best market prices from reputable gateways. Exchange rates are shown in real-time based on the user’s requirements, such as the crypto, amount, currency, and payment type. Best Wallet users can often complete their fiat purchases without needing to upload KYC documents.

Using a non-custodial wallet to swap fiat currency for crypto also unlocks complete control — only the user can access the private keys, eliminating the need to rely on custodians. Convenience is also enhanced, as purchased assets are deposited straight into the user’s wallet balance, so withdrawals from online exchanges aren’t needed.

Derivative platforms let traders speculate on crypto futures and options, often using high leverage. They support long and short positions so traders can attempt to make a profit from rising and falling prices.

While derivative sites historically only accepted crypto deposits, many now support fiat payments. Margex, for instance, which offers leverage of up to 100x on perpetual contracts, allows traders to buy crypto instantly with over 150 purchase methods, including debit/credit cards and Google/Apple Pay. Those funds can then be used to access leveraged products.

Peer-to-peer (P2P) platforms let investors buy crypto with fiat currency directly from sellers, typically with local payment methods like domestic bank transfers. Sellers list their exchange rates, and cryptocurrencies are transferred to the P2P exchange’s escrow wallet.

After the buyer makes the payment, the escrow wallet releases the funds, allowing them to withdraw the assets to a private wallet. P2P marketplaces often allow anonymous accounts, but some sellers will ask for ID from first-time buyers.

Here are the most important factors when choosing the best fiat-to-Bitcoin exchange.

Make sure the platform accepts your local currency — this ensures fiat purchases avoid unnecessary foreign exchange fees.

Available payment methods are just as important. Some exchanges accept debit/credit cards, bank transfers, and e-wallets like Skrill and Neteller.

Investors have two different options when moving fiat money into a crypto exchange.

The first method is the instant buy feature, which allows users to purchase digital assets on the spot, usually with Visa or MasterCard. This is the fastest option but typically comes with higher fiat-to-crypto fees.

The other method is to deposit local currency into the exchange account, usually via bank transfer. Once the funds arrive, users can purchase their favorite digital assets by placing market or limit orders.

Bank transfers used to be slow and expensive, but exchanges like Pionex, Coinbase, and Kraken now use local networks like ACH and SEPA, so payments often arrive near-instantly.

Ensure the exchange offers your preferred cryptocurrencies, whether that’s Bitcoin, Shiba Inu, Dogecoin, or XRP. MEXC is a good choice for asset diversification — the platform offers over 4,000 tradable markets. Other exchanges offer a much smaller range of assets, so investors should see what’s available before proceeding.

Note that fiat money payments are often available on selected coins rather than the full spot exchange library. One example is Pionex, which supports hundreds of spot markets, but traditional deposit methods can only be used to buy USDC.

Most fiat-to-crypto exchanges are centralized platforms, so client-owned assets are controlled by the provider. Exchange users must receive approval to withdraw purchased cryptocurrencies, which can take hours or even days. Centralized exchanges also have strict KYC procedures — users provide ID verification before they access fiat facilities.

An alternative option is non-custodial wallets like Best Wallet. Investors retain full control of their private keys and assets, eliminating the need to trust third parties. The wallet lets users buy crypto with fiat currency anonymously, too, so cumbersome KYC checks are avoided.

Fees vary considerably from one crypto exchange to the next. Credit card purchases average 3-5% on many platforms, while local bank transfers are often free.

The currency you use also impacts charges. Major currencies like USD and EUR enjoy premium liquidity, so trading fees are often reduced. Exotic currencies are significantly less liquid, so traders in emerging countries should expect to pay more.

Many online exchanges enable users to buy digital assets, but only a few support fiat withdrawals. This feature is crucial for those who want to swap crypto for local money and cash out the funds to a bank account or e-wallet.

Coinbase and Kraken offer same-day bank withdrawals without trading fees, but access is restricted to select countries. Best Wallet serves a much broader range of nationalities and currencies, making it a good choice for investors who can’t open accounts with tier-one platforms.

Here are the fees to look out for when researching crypto-to-fiat exchanges.

The instant buy feature allows users to purchase cryptocurrencies on the spot — payment methods are typically debit/credit cards from Visa and MasterCard, and popular e-wallets like PayPal and Google/Apple Pay.

Exchanges often charge higher fees on instant buys due to higher processing charges. It’s also a safeguard against potential chargebacks. Investors should expect to pay 3-5% of the transaction amount, which usually includes the trading commission. Some platforms include all fees in the quoted exchange rate, though, so make sure you review charges before the order is confirmed.

Regulated exchanges accept manual fiat currency deposits via bank transfer. Investors can use the funds they’ve deposited to place orders on the platform’s spot exchange. This payment option is often fee-free when local banking networks are used, such as ACH and SEPA.

International bank wires, however, often incur higher trading fees unless all charges are covered when users make the transfer.

The best fiat-to-crypto exchanges allow real-money withdrawals, usually to a bank account — this is often fee-free, just like manual deposits.

Unless you’re using the instant buy feature, trading commissions are paid on market and limit orders. Commissions average 0.1% per slide, and discounts are often available when trading large amounts.

All crypto exchanges apply spreads, which are the difference between the buy and sell prices of the traded market. The wider the gap, the more traders indirectly pay.

Investors can make fiat-to-crypto purchases in under 10 minutes from start to finish.

Here are the required steps.

Fiat facilities play a crucial role in crypto investing — top exchanges allow investors to buy digital assets with credit cards, PayPal, and other popular methods. Check available payment types, trading fees, supported currencies, security features, and KYC requirements before choosing an exchange.

In our view, Best Wallet is a top choice when trading crypto with fiat money. The non-custodial app offers instant payments at competitive fees, with millions of tokens available on 60+ networks. Best Wallet, as a decentralized ecosystem with an intuitive interface, provides users with anonymity, robust security, and complete ownership of their digital assets.

Visit Best Wallet

Yes, fiat-to-crypto exchanges let users convert traditional currencies like USD and EUR for digital assets. Payment methods often include Visa, MasterCard, and PayPal.

Best Wallet is the top fiat-to-crypto exchange for users who favor privacy, low fees, and non-custodial storage. MEXC is a good option for asset diversification, with over 4,000+ listed markets.

The fees when buying crypto instantly with credit cards and e-wallets average 3-5%. Local bank transfers (e.g., ACH or SEPA) are often fee-free.

Register with an online exchange that accepts your local currency and preferred payment method. Cryptocurrencies will be added to the exchange account after you make the fiat currency payment.

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

Weekly Research

Monthly readers

Expert contributors

Crypto Projects Reviewed

Jose Rafael Aquino is a Filipino writer and entrepreneur that specializes in finance, technology, cryptocurrency, and sports. Versed in the startup tech space, he has written for websites such as The GUIDON, TradingPlatforms, StockApps, and BuyShares. Read More

Maximize Your Trading With Margex’s 20% Deposit Bonus

Hottest Meme Coins to Buy in April? Retail Target Latest Crypto For Mega Gains

AR.IO Brings The Permanent Cloud to AI Storage Crisis

10 Best Crypto Bonuses in 2025 – Top Exchange Offers & Promotions

4 Days Left For Early Investors in World’s First Meme Coin Index: Meme Coin Mcap Hits $56Bn

Best Fiat-to-Crypto Exchanges 2025

Best Crypto Exchanges in Japan for 2025

Best Canadian Crypto Exchange in April 2025

CoinEx Review 2025: Earn More from 1,400+ Altcoins

7 Best No-Fee Crypto Exchanges in April 2025

What is Photon Crypto? Beginner’s Guide to Photon DEX

Let’s get social

© 2025 99bitcoins LTD, All rights reserved

Stay ahead with the latest updates, exclusive offers, and expert insights! Sign up for our newsletter today and never miss a beat.