Eric Huffman’s background includes a decade plus in business management as well as personal finance industry experience in insurance and lending. A strong understanding of consumer finance combined…

As the digital economy evolves, integrating cryptocurrencies into traditional financial systems becomes more critical. One significant step in this direction is adopting ISO 20022, a global standard for electronic data interchange between financial institutions.

ISO 20022 aims to streamline communication and improve the efficiency of financial transactions. Cryptocurrencies compliant with this standard are positioned to play a pivotal role in the future of finance. In this guide, we will explore the top ISO 20022 coins in 2024, discussing their background, objectives, and key features.

Let’s take a look at our ISO 20022 crypto coins list.

ISO 20022 candidates typically share key traits: strong institutional ties, low transaction costs, and high throughput. Most settle transactions in under 5 seconds and can process over 1,000 TPS.

We prioritized coins with enterprise adoption, cross-border utility, and compliance-ready architecture. These features suggest real-world integration potential — especially as ISO 20022 becomes the global messaging standard. Let’s explore the coins most aligned with that future.

XRP is the native cryptocurrency of the Ripple network, designed to facilitate fast and low-cost global payments. Launched in 2012, XRP has established itself as a leading digital asset for remittances and cross-border transactions, establishing itself as one of the top 10 cryptocurrencies and best ISO coins.

Ripple’s technology allows for quick settlement times, often within 3-5 seconds, and minimal transaction fees compared to traditional banking systems. By adopting the ISO 20022 standard, XRP aims to enhance its integration with global financial systems, improving the efficiency and interoperability of cross-border payments. This alignment with ISO 20022 supports Ripple’s vision of enabling instant and reliable transactions worldwide.

The widespread adoption of XRP by U.S. banks and financial institutions positions it well for future growth as financial systems continue to modernize and require more efficient transaction methods. For more information, read our XRP price prediction for 2024-2030.

Key Features:

Cardano is a proof-of-stake blockchain platform founded by Charles Hoskinson, co-founder of Ethereum. It emphasizes security, sustainability, and scalability, with a strong focus on academic research and peer-reviewed development. Cardano’s layered architecture provides enhanced security and allows for the ongoing development of new features and improvements.

Adopting ISO 20022 standards helps Cardano streamline financial communications and ensure compatibility with existing financial infrastructure. This move supports Cardano’s goal of creating a more secure and sustainable financial ecosystem. By becoming an ISO 20022 crypto, Cardano aims to facilitate smoother interactions with existing financial systems, thereby expanding its use cases and adoption. Check out our Cardano price prediction for more information.

Key Features:

Quant is a unique blockchain platform that focuses on interoperability between different blockchain networks. Through its Overledger technology, Quant enables seamless communication and transactions across various distributed ledger technologies. This capability is crucial for building interconnected blockchain ecosystems where assets and data can move freely and securely.

Quant’s adoption of the ISO 20022 standard aims to enhance its ability to connect disparate blockchain networks with traditional financial systems, promoting a more interconnected and efficient financial landscape. By leveraging ISO 20022, Quant seeks to provide enterprises with reliable and standardized messaging capabilities, enhancing the efficiency and security of their operations. Learn more on our Quant price prediction page.

Key Features:

Another ISO 20022-compliant coin is Algorand, a blockchain platform developed by Turing Award-winning cryptographer Silvio Micali. It focuses on solving the blockchain trilemma by providing a simultaneously scalable, secure, and decentralized platform. Algorand’s Pure Proof-of-Stake (PPoS) consensus mechanism ensures that the network remains efficient and robust without sacrificing decentralization.

Aligning with ISO 20022 standards, Algorand aims to improve its financial messaging capabilities and ensure seamless integration with historical financial systems. This alignment supports Algorand’s mission to create a borderless economy where value can be exchanged securely and efficiently across borders. Adopting ISO 20022 is a strategic move to enhance Algorand’s appeal to institutional users and large enterprises. Check out our full analysis on the Algorand price prediction page.

Key Features:

Stellar is an open-source, decentralized protocol that facilitates inter-regional transactions between any currencies. Launched in 2014 by Jed McCaleb, co-founder of Ripple, Stellar targets connectivities with financial institutions, payment systems, and individuals, enabling efficient and cost-effective financial services. The Stellar network is known for its fast transaction times and low costs, making it ideal for remittances and microtransactions.

In taking on the ISO 20022 standard, Stellar aims to enhance its compatibility with existing financial systems, enabling smoother and more efficient cross-border payments. This integration supports Stellar’s mission to create a global financial infrastructure that is accessible to everyone, reducing the friction and costs associated with historic banking systems. Explore more details on our Stellar price prediction page.

Key Features:

Hedera Hashgraph is a public distributed ledger that uses a novel consensus algorithm to achieve high throughput and low latency. Unlike traditional blockchains, Hedera’s Hashgraph technology allows for faster and more secure transactions, making it suitable for enterprise-level applications. Launched in 2018, Hedera aims to provide a secure and scalable platform for businesses and developers to build decentralized applications (dApps).

Adopting ISO 20022 protocols enhances Hedera’s ability to integrate global financial systems, ensuring secure and efficient financial messaging. This alignment supports Hedera’s goal of becoming a leading platform for enterprise solutions, providing businesses with a reliable and compliant infrastructure for their digital operations. Currently trading at approximately $0.16, Hedera has a total value locked of $94.61 million, compared to $25.0 million last year. For a detailed forecast, visit our Hedera price prediction page.

Key Features:

IOTA is a cryptocurrency designed for the Internet of Things (IoT), facilitating secure sales and trading data streams between devices. Unlike traditional blockchains, IOTA uses a unique ledger technology called the Tangle, which enables feeless and highly scalable transactions. Launched in 2015, IOTA aims to be the backbone of IoT, providing a secure and efficient method for devices to interact and transact.

By adopting ISO 20022 standards, IOTA (MIOTA) seeks to enhance its interoperability with financial institutions, ensuring that IoT transactions can be seamlessly integrated into the global financial ecosystem. This compliance supports IOTA’s vision of creating a secure and efficient infrastructure for the growing IoT industry, where billions of devices must transact and communicate autonomously.

Key Features:

XDC Network is a hybrid blockchain platform that combines the features of public and private blockchains, providing a versatile solution for enterprises. Launched by XinFin, the XDC Network aims to enhance global trade finance by offering secure, scalable, and cost-effective blockchain solutions. Its hybrid architecture allows for both public and private transactions, catering to businesses requiring confidentiality and compliance.

Adopting ISO 20022 standards helps XDC Network enhance its financial messaging capabilities, ensuring compatibility with the traditional financial sector. This alignment supports XDC’s goal of providing a reliable infrastructure for global trade and finance, making it easier for businesses to integrate blockchain technology into their operations securely and efficiently.

Key Features:

ISO 20022 is known as the global financial messaging standard for electronic data interchange between financial entities. Seen as the heir apparent to SWIFT, it provides a common language and model for financial messages, enabling better interoperability between various financial systems.

By the end of 2025, all financial institutions should be able to process ISO-compliant payments.

When it comes to cryptocurrencies, being ISO 20022 compliant means that a crypto asset adheres to this standard, facilitating smoother integration with traditional financial systems and enhancing transaction efficiency. ISO 20022 aims to streamline communication, reduce errors, and improve the speed and security of financial transactions. Adopting this standard can enhance cryptocurrencies’ utility and acceptance within the global financial ecosystem.

ISO 20022 is expected to have a positive impact on compliant crypto projects, building greater trust in the broader crypto sector. The standard aims to reduce fraud risks, enhance the efficiency of crypto transactions, and improve interoperability across members.

It will also improve communication between compliant crypto projects and traditional payment systems, bridging the gap between digital assets and traditional finance.

While most crypto assets are borderless, ISO-compliant digital assets will benefit from the standard’s acceptance across over 70 countries, expanding their global reach.

Experts believe that ISO coins will attract both institutional and retail investors due to their increased safety.

There are numerous benefits to being ISO tokens beyond potential adoption by mainstream and traditional financial institutions. These benefits include improved quality of data, interoperability, transaction speeds, and overall regulatory compliance.

One of the primary benefits of ISO 20022 compliance is the significant improvement in data quality. This standard ensures that financial messages contain more detailed and structured information, reducing ambiguities and errors. For cryptocurrencies, this means transactions can be more transparent and easier to audit, fostering greater trust and reliability.

Beyond data quality, ISO 20022 enhances interoperability between different financial systems. Cryptocurrencies that adopt this standard can seamlessly integrate with traditional banking systems, facilitating smoother cross-border payments and financial operations. This interoperability is crucial for broader adoption, as it bridges the gap between decentralized crypto assets and centralized financial institutions.

The standardized messaging format of ISO 20022 can lead to faster transaction processing times. By providing clear and concise information, the standard reduces the need for manual intervention and decreases the chances of delays. For cryptocurrencies, this can translate into quicker confirmation times and more efficient transaction flows, enhancing user experience and operational efficiency.

Lastly, ISO 20022 compliance helps cryptocurrencies align with regulatory requirements. As financial regulators worldwide adopt this standard, crypto assets adhering to ISO 20022 can more easily comply with legal and regulatory frameworks. This alignment can enhance the legitimacy and acceptance of cryptocurrencies, opening doors to institutional investments and broader market participation.

While adopting this standard and being on the Federal Reserve ISO 20022 crypto-list has several advantages, there are also some downsides.

Implementing ISO 20022 standards can be complex and challenging. The standard requires detailed and structured financial messaging, which can be difficult to integrate into existing crypto systems. This complexity can pose significant technical hurdles for developers and may require extensive resources to implement effectively.

The adoption of ISO 20022 can be costly. Financial institutions and crypto platforms may need to invest in new infrastructure, software, and training to comply with the standard. These costs can be substantial, particularly for smaller crypto projects, potentially hindering their ability to adopt ISO 20022 fully. This has been apparent within the wider financial community, with the overall adoption rate for the ISO 20022 standard lagging at 18%, according to research from EY.

While ISO 20022 compliance can enhance regulatory alignment, it also increases scrutiny. Cryptocurrencies adhering to this standard may face more rigorous oversight from regulators, which could impose additional compliance burdens. This heightened scrutiny might deter some projects from pursuing ISO 20022 compliance, particularly those seeking to maintain operational flexibility.

The main goal of ISO-compliant crypto projects is to build a secure and efficient infrastructure for payments and other financial operations – making them less about speculation and more about long-term utility.

However, adopting the ISO standard can be a bullish signal for crypto assets, as the move can lead to increased demand and interest from institutional investors.

As a result, ISO coins could offer strong potential for long-term investment.

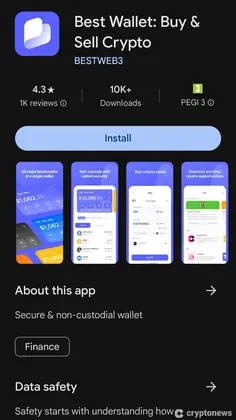

Best Wallet is one of the easiest ways to buy most ISO 20022 coins. The non-custodial wallet supports over 60 blockchain networks and their native coins, including Cardano, Algorand, and Hedera.

The great thing about Best Wallet is that it offers the swap feature directly in the app by connecting with major decentralized exchanges (DEXs).

Unlike major crypto exchanges like Coinbase, Best Wallet gives you full custody and control over your assets.

Here is a quick guide on how to buy ISO coins with Best Wallet:

Step 1: Download Best Wallet

Search for Best Wallet on Google Play Store or Apple App Store and install it for free.

Step 2: Set Up and Secure Your Wallet

Open the app, set it up based on instructions, and secure it by enabling two-factor authentication (2FA) and writing down your recovery phrase.

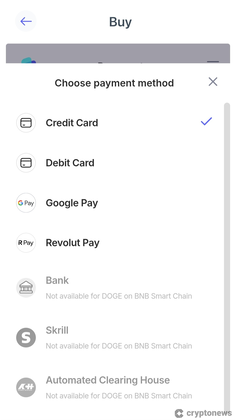

Step 3: Fund Your Wallet

If you hold USDC, USDT, or ETH, you can deposit it into Best Wallet to swap for ISO coins. You can transfer crypto from another wallet or purchase it directly in the app with your credit card.

Step 4: Find ISO Coins

Find the ISO coins of interest in the wallet’s search box or by scrolling through the supported cryptocurrencies.

Step 5: Buy the Token

After selecting the crypto coin, you can initiate the purchase. Best Wallet will connect to a DEX like Uniswap, offering the best rates.

ISO 20022 compliance represents a significant step forward for cryptocurrencies, offering numerous benefits such as enhanced data quality, interoperability, faster transactions, and regulatory compliance. While implementing this standard can be challenging, the potential advantages make ISO 20022-compliant cryptocurrencies a compelling option for investors and users alike.

As the financial industry continues to evolve, adopting ISO 20022 could play a crucial role in bridging the gap between traditional financial systems and the emerging world of digital assets.

There are several ISO 20022-compliant coins, including XRP, Cardano, Quant, Algorand, Stellar, Hedera Hashgraph, IOTA, and XDC Network.

ISO 20022-compliant coins include XRP, Cardano, Quant, Algorand, Stellar, Hedera Hashgraph, IOTA, and XDC Network.

Yes, XRP is an ISO 20022-compliant coin.

ISO 20022 replaces various older financial messaging standards such as SWIFT.

Yes, ISO 20022 is a big deal because it enhances interoperability, data quality, and efficiency in financial transactions. It can also help integrate cryptocurrencies with the traditional finance system.

No, Bitcoin is a decentralized peer-to-peer (P2P) cryptocurrency that was designed to operate outside the traditional financial system, so it doesn’t comply with financial messaging standards.

Ethereum itself is not compatible with the ISO 20022 standard. However, Ethereum-based decentralized applications (dApps) could potentially align with the standard.

Get dialed in every Tuesday & Friday with quick updates on the world of crypto

Our goal is to offer a comprehensive and objective perspective on the cryptocurrency market, enabling our readers to make informed decisions in this ever-changing landscape.

Our editorial team of more than 70 crypto professionals works to maintain the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re looking for breaking news, expert opinions, or market insights, Cryptonews has been your go-to destination for everything cryptocurrency since 2017.

Get dialed in every Tuesday & Friday with quick updates on the world of crypto

The information on this website is for educational purposes only, and investing carries risks. Always do your research before investing, and be prepared for potential losses.

18+ and Gambling: Online gambling rules vary by country; please follow them. This website provides entertainment content, and using it means you accept out terms. We may include partnership links, but they don’t affect our ratings or recommendations.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and are not intended for UK consumers.